China’s domestic steel prices are expected to rebound in March as market conditions and steel fundamentals will both likely change for the better, according to Mysteel’s chief analyst Wang Jianhua.

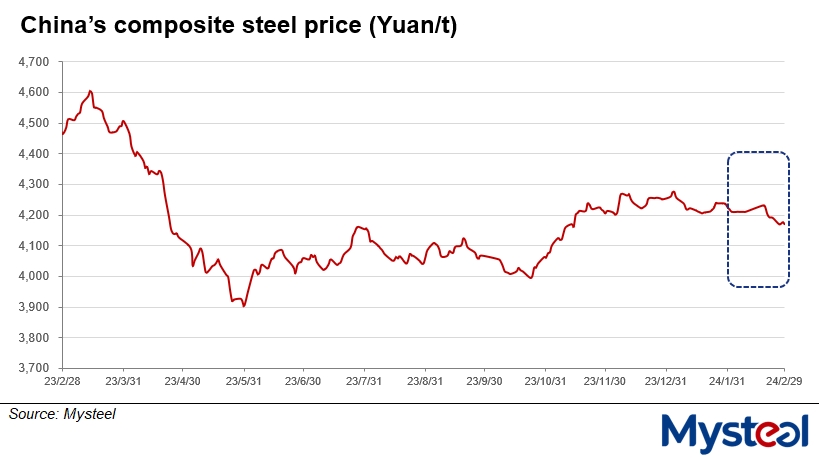

The country’s steel prices trended down during February, with Mysteel’s assessment of the national composite steel price reaching Yuan 4,177.16/tonne ($587.8/t) as of February 28, losing Yuan 47.9/t since January 31.

The decline in steel consumption around the Chinese New Year (CNY) holiday over February 10-17 had weighed on steel prices in early- and mid-February, Wang explained. After that, adverse weather conditions in the latter part of February caused the operations of steel end-users to resume more slowly than expected, which triggered pessimism in the steel market and led prices to drop rapidly, he added.

However, “the bearish sentiment will largely fade by end-February or early March and will turn brighter on the positive macro-economic indicators and improved fundamentals,” Wang predicted.

“Both individuals and enterprises in China have become more active in loan applications,” he observed, pointing out that the central government is also continuing to enhance economic policy support. He also cited the large reduction in the five-year loan prime rate the People’s Bank of China had announced earlier this month.

The better market mood will create a favourable environment for a rebound of domestic steel prices, according to Wang, while the likely growth in steel demand will lay a solid foundation for the price rise.

“With daytime temperatures increasing throughout the country in March, China will see activity at building sites increase at a faster pace and domestic demand for construction steel will climb,” he explained.

Mysteel’s survey shows that domestic building contractors are indeed ramping up their operations post the CNY holiday. As of February 27, the average operational rate on the 10,094 construction projects Mysteel tracks nationwide had increased to 39.9%, higher by 1.5 percentage points compared with the same period after last year’s CNY holiday.

Also on February 27, the trading volume of construction steel products including rebar, wire rod and bar-in-coil among the 237 Chinese trading houses under Mysteel’s other survey had rebounded to 107,564 tonnes, surging 99.8% from the previous day.

On the other hand, steel supply has not shown any marked rise since the holiday ended, Wang pointed out.

For example, during February 16-22, the daily average production of hot metal among the 247 blast furnace steel mills under Mysteel’s regular tracking stood at 2.24 million tonnes/day, lower by 10,400 t/d on week.

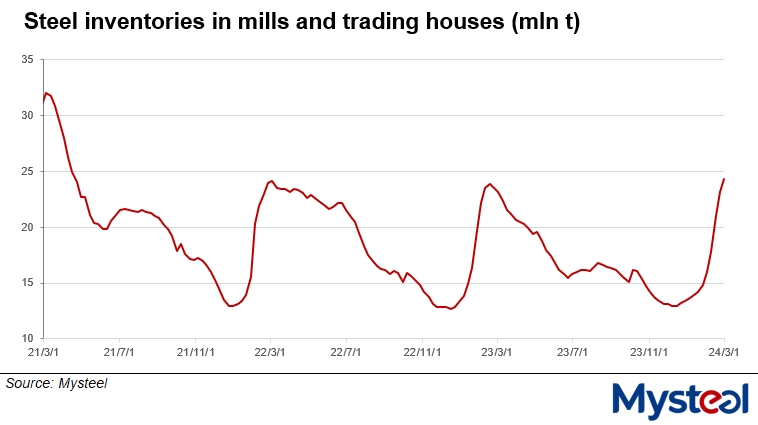

As such, the steel inventories held by Chinese steelmakers and traders are expected to stop rising and start to decline by mid-March at the latest, Wang predicted, noting that this may further buoy steel prices.

As of February 29, total inventories of the five major carbon steel products held by the 184 steelmakers and traders in 35 Chinese cities had grown by 52.2% on month 24.3 million tonnes, according to Mysteel’s survey.

The strengthening of steel prices may also give a boost to prices of steelmaking raw materials, Wang believed. “Prices of iron ore and coke have both dropped by a large margin so far this year, and the prices will probably bottom out once steel prices recover,” he explained.

Source: MySteel