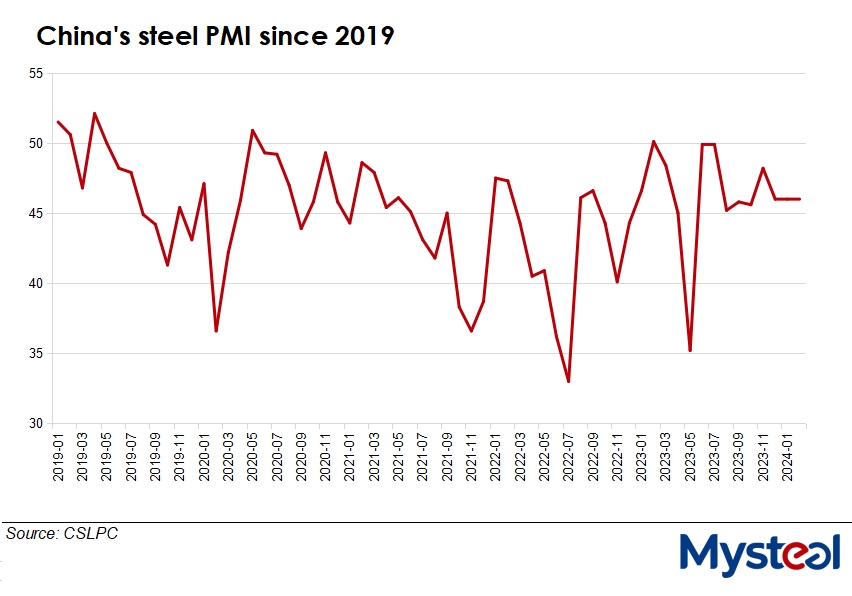

The Purchasing Managers’ Index (PMI) for China’s steel industry remained unchanged for the second month at 46 in February, according to the latest release by the official index compiler CFLP Steel Logistics Professional Committee (CSLPC) on Friday. Last month, the domestic steel market was still in the midst of winter, an off-season for steel consumption, the committee explained, while the Chinese New Year holiday also disrupted steel-related activity.

During February, steel production remained steady, domestic steel demand shrank further, and finished steel inventories mounted moderately, according to CSLPC. Meanwhile, raw materials prices declined substantially and prices of finished steel spiralled down, it noted.

The substantial weakening of demand saw the sub-index of new steel orders including domestic sales and exports slip by 2.4 percentage points on month to a nine-month low of 41.4 in February, as construction work came to a halt and market participants also closed their businesses for the holiday celebrations. In addition, the pace of the recovery in demand after the holiday was slow, CSLPC said.

On the other hand, last month China’s steel production sub-index took a pause from its two-month dip to rise by 1.5 percentage points from January to 45.2, showing stable production among steelmakers, with mills gradually resuming operations after the holiday break despite the fall in demand.

Daily crude steel output among the member mills of the China Iron and Steel Association (CISA) grew further during February 11-20, edging up by 1.5% or 31,000 tonnes/day from the prior ten days to average 2.1 million t/d, the committee said, quoting CISA data.

Meanwhile, steady output and stalled demand saw finished steel stocks held by CISA member mills jump by a further 17.7% or 2.8 million tonnes from February 10 to approximately 19 million tonnes by February 20, as reported.

The production-cost pressure on domestic steel mills eased during February due to the large fall in raw materials prices, according to CSLPC. The sub-index for steelmaking raw materials prices dropped by 8.2 percentage points on month to 49.6 – marking a return to the contraction zone after seven months.

For March, the committee estimated that the pickup in domestic steel demand will likely be slow as the property market may remain sluggish. Steel production will rise further overall this month as the mills’ production enthusiasm may be boosted by the lower production costs.

Moreover, raw materials prices may decrease steadily during March, and prices of finished steel products may also trend downwards as the growth in output will outpace that of demand, the committee expected.

Written by Rong Zhang