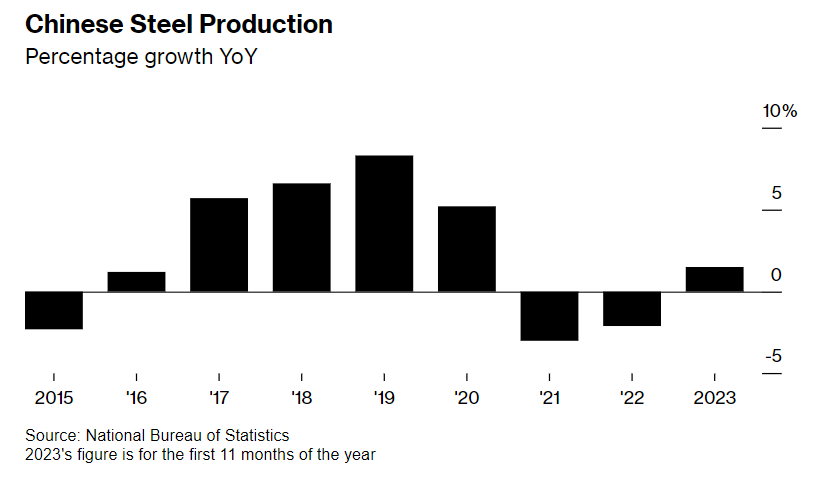

Chinese steel production looks set for its first annual gain in three years as economic concerns are prioritized over the need to cut emissions from the highly pollutive sector.

Output in November fell 3.8% from the previous month to 76.1 million tons, the statistics bureau said Friday. However, the December figure would need to drop to less than 61 million tons, the lowest monthly total in 11 years, to prevent annual output topping last year’s 1.013 billion tons.

Beijing has capped production at the prior year’s level after output surged above 1 billion tons for the first time in 2020, fueling concerns that unabated growth would hinder its ability to meet its climate goals. The steel industry accounts for about 15% of the nation’s emissions. But a stuttering economy has opened the door to more steel-intensive stimulus from the government, which mills will be keen to tap into after China’s property crisis caused margins to collapse over the past two years.

Chinese Steel Production

Still, the picture is complicated by falling profits at mills and Beijing’s mixed signals on demand.

Steelmakers typically throttle back production at the end of the year as construction slows and curbs are put in place to ease pollution because more coal is burned for winter heating. In the first 10 days of December, average output at major mills dropped 4.2%, according to the latest industry figures.

That tallies with pressure on profits becoming more acute in recent weeks. The margin on reinforcement bar used in construction fell to break-even earlier this month after turning positive at the start of November, according to BloombergNEF, which would incentivize mills to churn out less steel.

And the government’s intentions on stimulus aren’t clear cut. A plan in October to issue additional debt worth 1 trillion yuan ($139 billion) in the fourth quarter to support disaster relief and construction was cheered by the market. But some of Beijing’s pronouncements since have fallen short of signaling that huge spending on public works will continue in the new year.

Other Avenues

The industry has worked hard to bolster other channels for consumption to offset the impact of the property crisis. “Steel exports and manufacturing sector demand have remained resilient,” said Xie Jinshan, an analyst at Horizon Insights. That suggests real estate could be less of a drag going forward, and replacement demand from infrastructure less necessary to support the market.

The authorities may also be relaxed about missing their production target if they calculate that emissions have still fallen: China’s steel industry is slowly getting greener as mills swap out older plants for more efficient and less carbon-intensive capacity. In any case, it’s economics rather than environmental concerns that are deciding the trajectory of the market.

“The Chinese government will likely adjust their environmental targets according to the prevalent economic pressures,” said Horizon’s Xie.