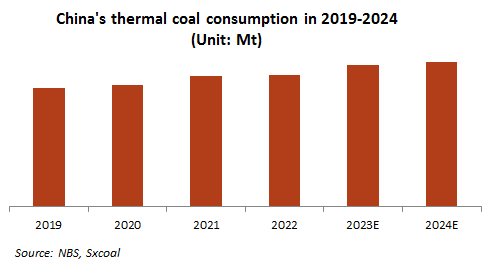

China witnessed a continuous expansion of advanced coal production capacity from 2021 to 2023. The combination of robust output and substantial coal imports led to a relaxation of supply-demand dynamics. With the continued implementation of favorable macroeconomic policies in 2024, China’s thermal coal consumption is anticipated to keep growing at a more moderate rate, while the supply remains relatively ample.

The year 2023 witnessed a notable recovery in the Chinese economy as COVID-19 restrictions were gradually lifted, leading to a year-on-year surge in thermal coal consumption. China is projected to have consumed 4.02 billion tonnes of thermal coal last year, up 7.1% from a year ago, which expanded by 5.8 percentage points due to the low base in 2022, according to the latest annual report released by industry consultant Fenwei.

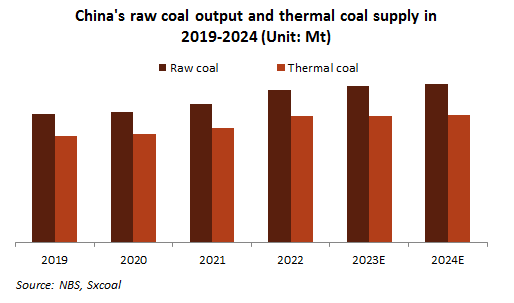

Following vigorous development of coal production capacity in 2021-2022, new capacity deployment and expansion experienced a reduction in 2023. As a result, newly added capacity was lower than the previous two years, with the majority still being of thermal coal.

Frequent mine accidents at major producing regions in the latter half of the year led to intensified safety inspections, restricting the release of production capacity to some extent. Overall, Fenwei anticipated thermal coal supply in China to be 3.77 billion tonnes for the whole year of 2023, a marginal increase of 0.2% on the year. Improved international supply conditions, coupled with China’s favorable import policies, led to a historical high in China’s 2023 coal imports.

Fenwei predicted the country’s coal imports to exceed 470 million tonnes last year, jumping 61.7% year on year, with thermal coal imports soaring 62.3% to 370 million tonnes.

Looking ahead to 2024, with further implementation of the government’s pro-growth policies, continued growth is anticipated in China’s electricity demand, with thermal power playing a pivotal role. Coal consumption for power generation will also continue to increase.

However, coal use in metallurgical and construction sectors will face constraints, while that in the chemical sector is expected to maintain a relatively high growth rate due to the promotion of clean coal utilization. Additionally, the expansion of centralized heating will contribute to an increase in coal consumption for heating.

The overall demand for thermal coal is expected to moderately rise as additional non-fossil energy capacity is installed and clean energy utilization improves.

Under steady economic development, China’s demand for energy is expected to continue growing and coal is anticipated to maintain its predominant role in the energy mix, owing to still low utilization of non-fossil energy sources.

However, the domestic coal market is experiencing a gradual easing of the supply-demand situation, along with a significant surge in coal imports. This, coupled with constraints imposed by carbon peaking and carbon neutrality goals, stringent safety inspections, will lead to a decline in raw coal production growth, including potential reductions in thermal coal supply.

“It is essential to highlight that intensified safety inspections will have a more pronounced impact on coal mines with safety hazards, while medium- to large-sized coal mines with higher levels of intelligence and standardization will be relatively less affected.”

Additionally, coastal regions are expected to maintain high thermal coal imports, featuring a reduced rate of signing long-term domestic coal contracts and increased reliance on cost-competitive imported coal. The reintroduction of import tariffs in China is likely to somewhat curtail the rise in imports of Russian and Mongolian coal. Both total coal imports and thermal coal imports are projected to decrease in 2024.

Overall thermal coal prices were weak in 2023 owing to the improved supply-demand fundamentals, high coal inventory and obvious price advantage of imported coal. The average price of 5,500 Kcal/kg NAR thermal coal at Qinhuangdao port was 966 yuan/t ($134.97/t), down 303 yuan/t compared to 2022. The average level is forecast to move lower in 2024 amid a loose supply of thermal coal.