Chinese steel traders saw their stocks of finished steel at hand decline further over March 29-April 4, thinning another 1.1 million tonnes on week faster than the 797,100-tonne fall in the previous week mainly due to the rise in spot trading and the replenishment needs of end-users ahead of China’s Qingming Festival holiday over April 4-6, according to Mysteel’s weekly survey.

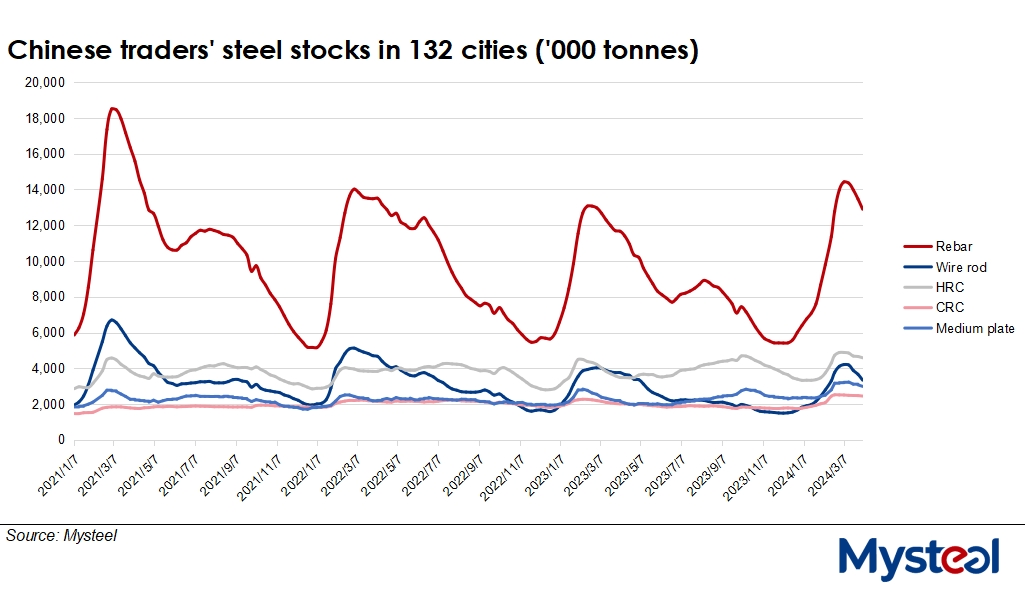

The inventories held by traders Mysteel tracks in 132 cities nationwide decreased for the fourth straight week by 3.9% on week to 26.3 million tonnes as of April 4, the latest survey data found.

The surveyed traders’ holdings of rebar and wire rod shrank the most among the five major finished steel items, falling by 572,700 tonnes and 326,600 tonnes on week to 12.9 million tonnes and 3.3 million tonnes respectively over the period. The other three items are hot-rolled coil, cold-rolled coil and medium plate.

“Steel demand from building contractors had been steadily rising, and spot trading in our market had clearly been active,” said an industry watcher in Southwest China.

Mysteel’s survey of the spot sales of rebar, wire rod and bar-in-coil among the 237 traders’ warehouses nationwide was in line with the source’s perspective, as their daily trading volume gained by 16.5% on week to average 152,235 tonnes/day over March 28-April 3.

On the other hand, mixed sentiment caused China’s domestic steel prices to become volatile last week, with Mysteel’s assessment of the national price of HRB400E 20mm dia rebar, for example, dipping to Yuan 3,614/tonne ($500/t) and including the 13% VAT on April 3, softening by Yuan 39/t on week.

The inventories of five finished steel products in Mysteel’s smaller sample across just 35 cities also declined by 3.2% or 534,100 tonnes on week to 16.1 million tonnes as of April 4.

Source: Mysteel