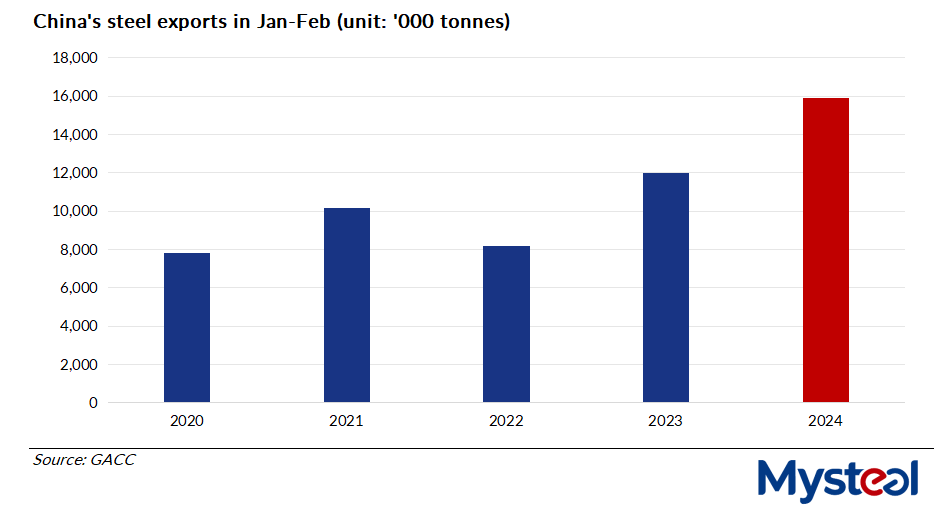

Over January-February this year, China’s finished steel exports surged by 32.6% on year to reach 15.91 million tonnes, according to the latest statistics from the country’s General Administration of Customs (GACC) on March 7. Meanwhile, the country imported 1.13 million tonnes of steel products during the first two months, down by 8.1% on year.

China began to release combined trade data for January-February in 2020 to factor out disruptions to trade caused by the Chinese New Year holiday, which typically falls in the two months.

China’s steel shipments during the first two months of this year were mainly to fulfil orders signed back in November and December last year.

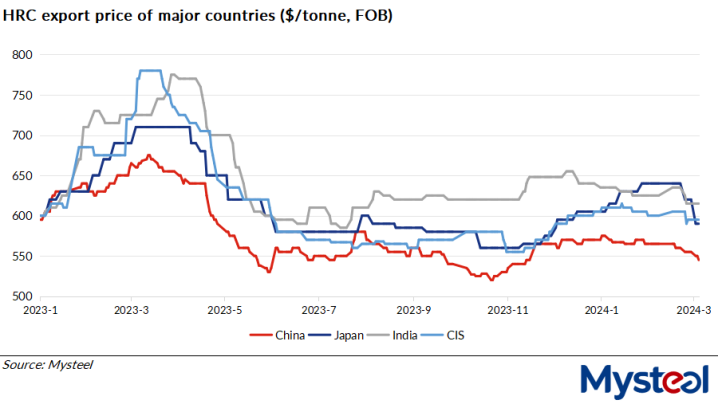

Back then, Chinese steel products largely maintained their price advantage in the international steel market. In fact, the price advantage was also the major reason that had kept China’s steel exports at high levels throughout last year, Mysteel’s chief analyst Cao Jianyong commented.

For example, as of December 29, the export price of Chinese SS400 4.75mm hot-rolled coil (HRC) was assessed by Mysteel at $570/t FOB from North China’s Tianjin port, lower by $35/t than that of Japan-origin offers on the same day.

The rather adverse weather last winter saw China’s domestic steel consumption become even weaker in the traditional off-season for steel demand. Moreover, many Chinese steel producers faced squeezed or even negative profit margins, largely due to high prices of key steelmaking raw materials including iron ore and coke. These factors forced Chinese steel producers to actively seize overseas trading opportunities during last November and December.

For example, the daily transaction volume of construction steel comprising rebar, wire rod and bar-in-coil among 237 Chinese trading houses under Mysteel’s survey averaged 134,806 tonnes/day in last December, rising by a mild 2.7% from December 2022 when the domestic steel market had just slowly recovered from the impact of COVID-19.

Meanwhile, Mysteel’s other survey showed that by the end of last December, the profitability ratio among 247 blast furnace mills across China only recorded 28.14%.

Written by Carly Chen