China’s imports of coking coal from all origins during January-February 2024 totalled 17.89 million tonnes, logging a jump of 36.5% on year, Mysteel Global learned from data released by the country’s General Administration of Customs (GACC) on March 22.

The significant on-year rise over the past two months was attributed to the low base in the same period last year when China’s economy was still recovering from the impact of the Covid-19 pandemic, Mysteel Global learned. China ended its zero-COVID policy in early December 2022, and positive cases had surged shortly thereafter before tapering off a few months later.

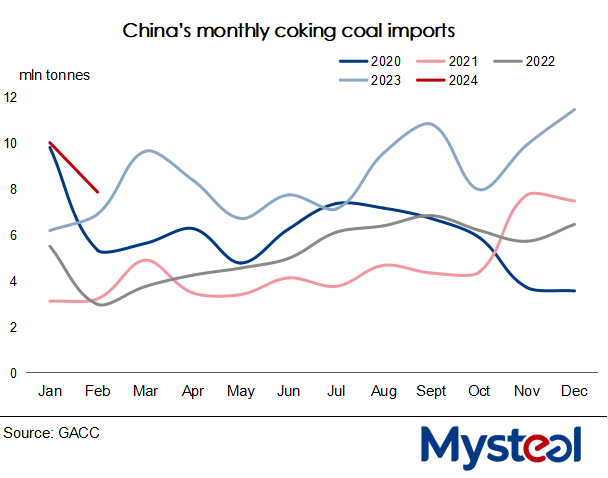

In detail, coking coal imports during January this year reached 10.02 million tonnes, higher by a sizzling 62% from a year earlier but down 13% from December, while in February, the import volume dropped by 22% on month to 7.87 million tonnes, the GACC data show. The February result was still 14% higher than that for February last year, however.

The reduction in coking coal imports last month compared with January was mainly caused by the Chinese New Year holiday that spanned February 10-17 this year, Mysteel Global noted.

Apart from the holiday break, another factor dragging down China’s coking coal imports in February was waning demand for the raw material as domestic steel mills – struggling with persistent losses due to the slow recovery of steel demand after the holiday – were unwilling to lift their hot metal output, as reported.

Given that Chinese mills had limited appetite for purchasing feed coal, Chinese importers cut their purchases of coking coal from other countries, a Shanghai-based analyst said.

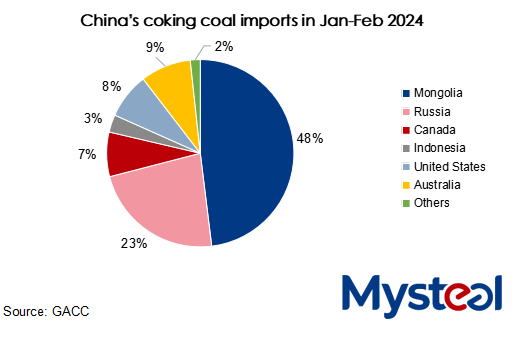

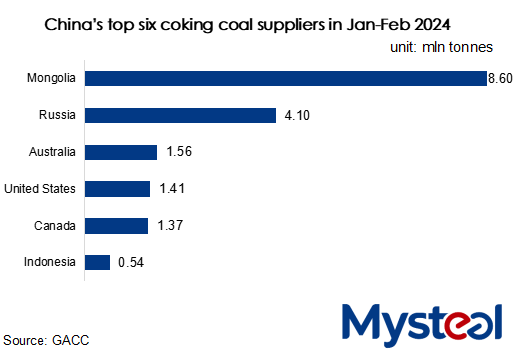

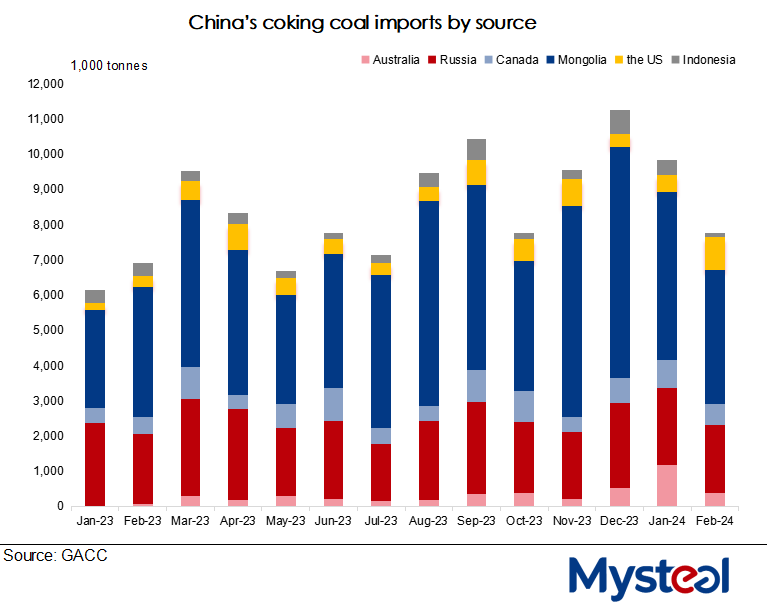

Mongolia and Russia, the top two suppliers of coking coal to China, still dominated China’s coking coal import market in the first two months of this year, enjoying market shares of 48% and 23%, respectively.

However, Chinese buyers of Russian coking coal felt the pressure of China’s coal import tariffs that had been restored in January, as reported. This resulted in a 6% on-year decline in China’s intake of Russian coking coal in the first two months of this year, with the total reaching 4.1 million tonnes, the GACC statistics indicate.

As for Mongolia, China’s largest provider of coking coal, the influence of reinstated tariffs seemed negligible as the country kept delivering vast amounts of coking coal to China – trade that was helped by improved rail links between the two countries.

In January-February, Mongolia shipped 8.6 million tonnes of coking coal to China, 33% higher than the year-earlier level, according to the GACC data.

Significantly, coking coal imports from Australia totalled 1.56 million tonnes over the first two months of this year, more twenty times the volume shipped during the same period last year when Beijing’s unofficial import ban on it had just been lifted, the same data show.

The massive tonnage not only made Australia the third largest coking coal supplier to China over the last two months with a 9% market share, but the uptick also suggests that Australian coking coal is staging a striking comeback to China’s market.

The United States and Canada exported 1.41 million tonnes and 1.37 million tonnes of coking coal to China in January-February, with the former surging by 177% on year and the latter growing by 51%, the Customs data show.

Meanwhile, Indonesia experienced negative growth in its coking coal shipments to China over January-February, with the tonnage falling by 26% on year to reach 542,700 tonnes, the GACC data suggest.

Written by Irene Zhuang