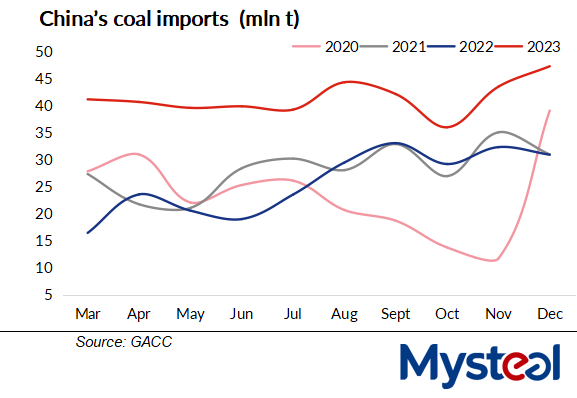

China imported 474.42 million tonnes of all types of coal and lignite during 2023, higher by a sizzling 61.8% from 2022 and an all-time record high, new data from the country’s General Administration of Customs (GACC) released on January 12 show.

The full-year record resulted from a similarly record-breaking total of 47.3 million tonnes of both commodities China had imported in December, up by 8.7% from November and by 53% on year, the GACC statistics show.

Last month China, despite being the world’s largest coal producer, stepped up efforts to import coal supplies, particularly thermal coal, to help weather freezing temperatures, Mysteel Global noted. Thermal coal imports usually account for more than 70% of China’s total coal imports, according to GACC historical data.

On December 16, the China Meteorological Administration had issued a warning about a looming fall in temperatures, the first of its kind last year, cautioning that widespread cold waves would cause steep declines in temperatures in large parts of the country in the following week, as Mysteel Global reported.

Bracing themselves for the rising power demand from households needing to keep warm, Chinese power plants became aggressive in importing thermal coal from their main suppliers to support peak power generation.

Indeed, daily coal burns at the 256 surveyed power plants that Mysteel regularly tracks nationwide jumped by a marked 11.6% on week to reach 2.61 million tonnes over December 16-22, Mysteel’s tracking data show.

The massive consumption of coal had also resulted in a large fall in the coal stocks held by these 256 power plants. By December 29, their stocks had fallen by about 5.8% on month to 46.92 million tonnes, enough for only 18 days of usage, according to the same data.

“Another driving force behind China’s growing appetite for imported thermal coal last month was the superior cost performance of foreign coals when compared with domestic resources,” an analyst based in North China’s Shanxi suggested.

For example, the average FOB price of Indonesian 3,800 kcal/kg NAR thermal coal under Mysteel’s assessment was Yuan 93.4/tonne ($13/t) cheaper than a comparable grade produced in China last month, larger than the price spread of Yuan 82.3/t in the prior month, Mysteel’s data show.

However, with the reimposition of import duties on many types of coal from January 1 this year, Chinese buyers will find foreign coal supplies, especially coking coal, less attractive, as reported. And this could drag this year’s imports down from last year’s record, Mysteel Global notes.