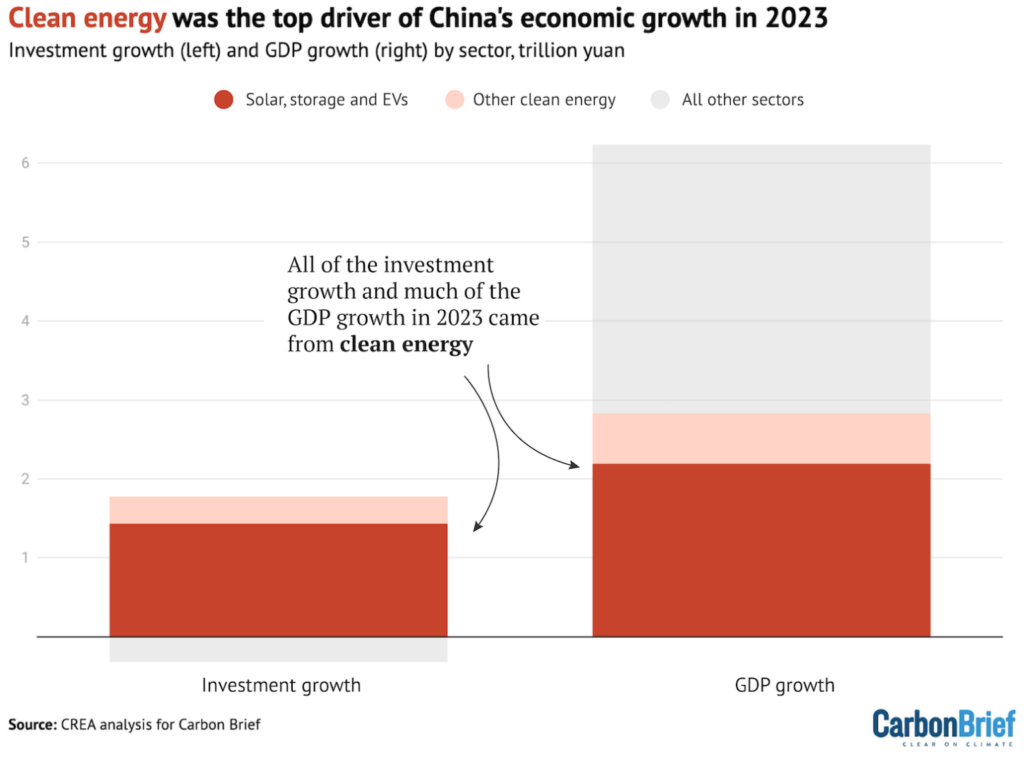

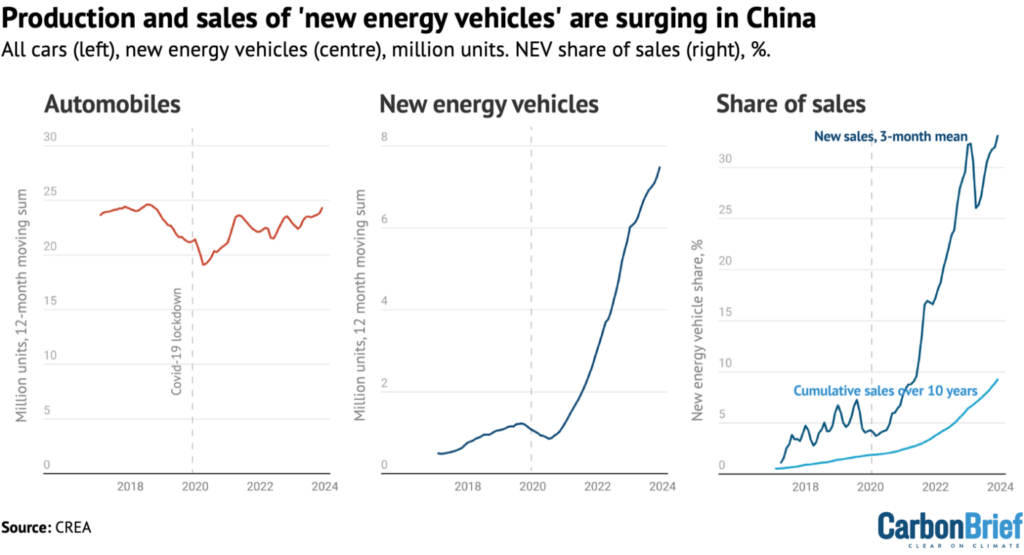

In 2023, China’s clean energy sector significantly boosted its economy, contributing a record 11.4 trillion yuan ($1.6 trillion). This contribution accounted for all the growth in investment and a larger share of economic growth than any other sector. The surge in clean energy investment, particularly in solar power, electric vehicles (EVs), and batteries, was a key factor.

Key points include:

- Investment in Clean Energy: Investment in clean energy rose by 40% year-on-year to 6.3 trillion yuan ($890 billion). This growth accounted for all investment growth across China’s economy in 2023.

- Global Context: China’s investment in clean energy ($890 billion) was almost equal to the global investment in fossil fuel supply and similar to the GDP of countries like Switzerland or Turkey.

- Economic Impact: Clean energy sectors contributed 11.4 trillion yuan ($1.6 trillion) to China’s economy, up 30% from the previous year. They accounted for 40% of the expansion of China’s GDP in 2023.

- GDP Growth Dependency: Without this sector’s growth, China’s GDP would have only risen by 3.0% instead of 5.2%, missing the government’s growth target.

- Real-Estate Sector Decline: The real-estate sector in China shrank for the second consecutive year, shifting focus to clean energy as a key part of China’s economic and industrial policy.

- Overcapacity Concerns: There’s a risk of overcapacity in clean energy investments, suggesting that this rapid growth might not be sustainable indefinitely.

- Global Economic Stake: The growing importance of clean energy industries gives China a significant stake in the global transition to clean energy technologies.

- Policy Implications: This shift poses challenges for overseas policymakers trying to align their climate strategies with domestic industrial growth.

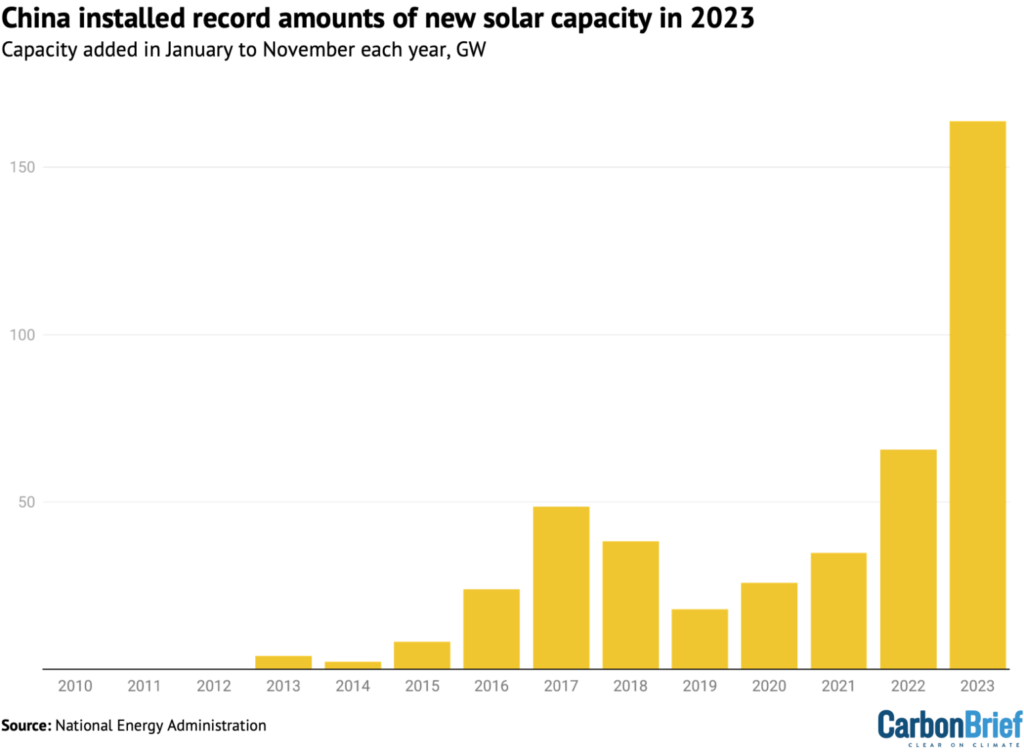

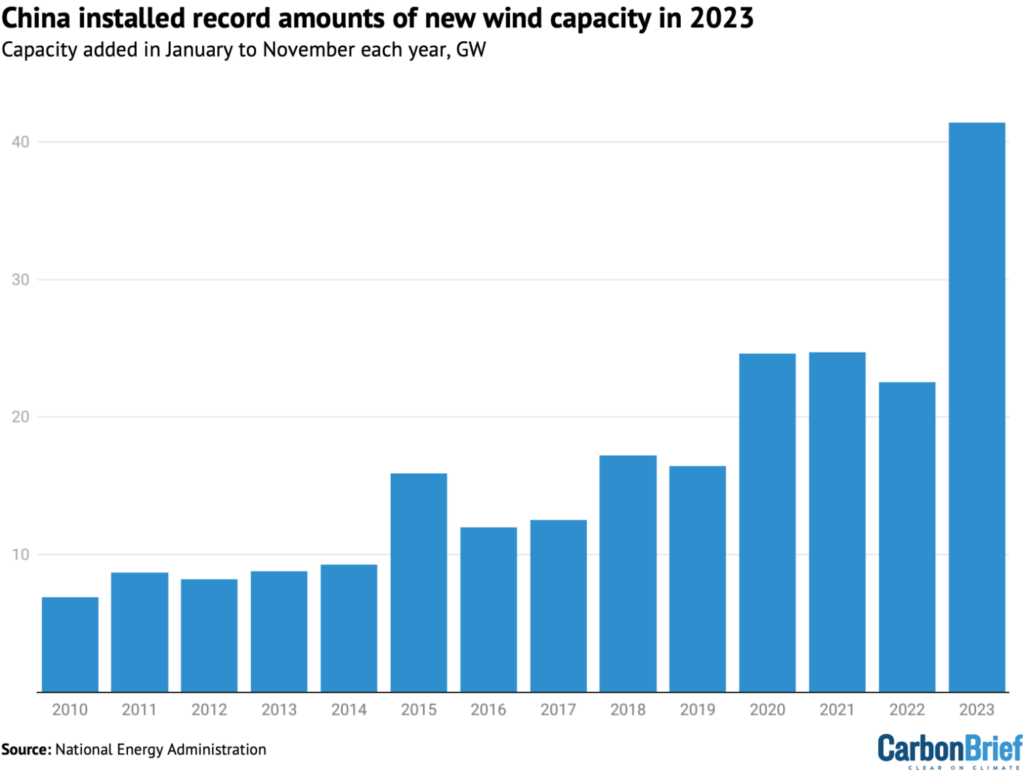

- Detailed Sector Analysis: Investments and growth were observed across various sectors – solar, wind power, EVs, energy efficiency, electricity storage, hydrogen, and railways. Notably, solar power saw a significant increase in investment and production capacity.

- Global Influence and Future Implications: China’s clean energy manufacturing boom has lowered global prices for solar panels and batteries, impacting global clean energy adoption. However, the potential saturation of the market could lead to overcapacity issues. Additionally, China’s dominant position in the clean-energy supply chain presents a strategic choice for other countries regarding supply diversification and investment in domestic production.