The stocks of finished steel that Chinese steel traders will be holding this winter will likely be relatively low compared with other years, Mysteel’s latest report suggests, pointing out that the prevailing high prices of steel products are discouraging traders from putting too many tonnes aside for early next year, especially when the outlook for steel demand next spring is generally pessimistic.

A long-established practice among steel traders and distributors across China is to use the winter months to gradually accumulate steel – when demand is poor, and steelmakers are more willing to offer discounts – to be ready when building activity perks up with the approach of spring. This is generally after the traditional Chinese New Year holiday which in 2024 will end around February 18, Mysteel Global notes.

Previously, Mysteel’s survey in late October found that only 238 or 34.4% of the respondents among the 692 enterprises sampled across major Chinese steel markets said they had restocking intentions for this winter. Among the sample were 643 traders and the top impediment most cited for not accumulating inventory was pessimism about China’s steel demand next year, as reported.

Two months have now passed and steel traders are still not very active in building their winter steel stocks, with the higher-than-expected steel prices at the moment becoming another major disincentive for traders’ stocking, Mysteel’s report observed.

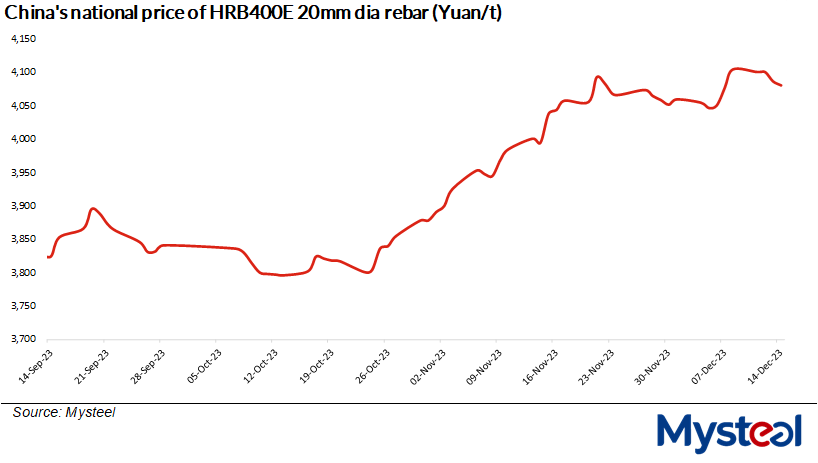

As of December 13, China’s national price of HRB400E 20mm dia rebar, a barometer of the country’s steel-market sentiment, was assessed by Mysteel at Yuan 4,087/tonne ($573.1/t) including the 13% VAT, higher by Yuan 219/t or 7.7% from October 13.

On the contrary, those traders pondering whether to build stocks of the long product preferred a lower price of about Yuan 3,600-3,700/t, Mysteel’s survey showed.

In fact, both Chinese spot and futures prices of rebar have been strengthening overall since mid-October, supported by rising raw materials prices, the launch of new economic stimulus measures and market hopes of additional policies favourable to steel consumers being released by the government.

However, steel-market optimism about further significant stimulus policies has cooled this week as the two-day economic planning conference in Beijing had ended on December 12 without any new substantial stimulus measures being announced, as reported.

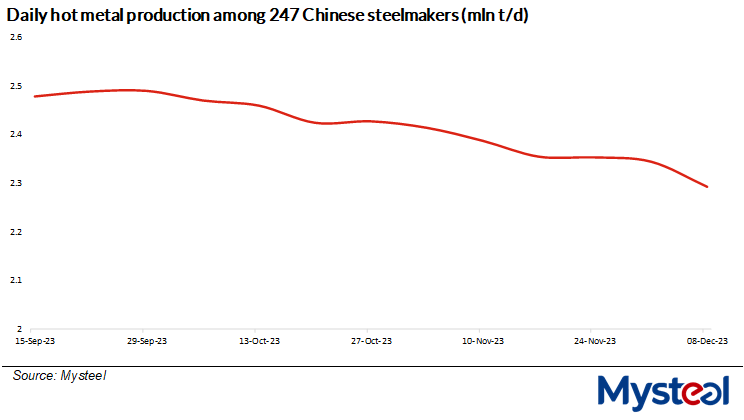

Nevertheless, declines in steel supply will continue to support the relatively high steel prices, Mysteel’s report predicted, explaining that more steelmakers will observe work stoppages to conduct maintenance on their steelmaking facilities by the end of year.

Over December 1-7, the daily hot metal output among the 247 Chinese steel producers under Mysteel’s tracking averaging 2.29 million tonnes/day, falling by 196,900 t/d or 7.9% from the previous high of 2.49 million tonnes in late September.

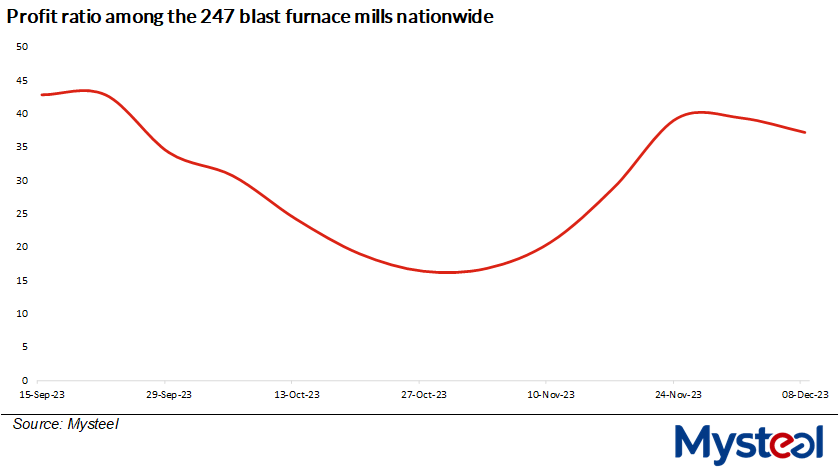

Besides, steelmakers are unlikely to be generous in the discounts they’re offering this winter as they have been bearing razor-thin profit margins and even losses on steel sales, Mysteel’s report added.

During December 1-7, only 37.2% of the sampled 247 mills being able to earn some profits selling their steel, Mysteel’s latest weekly survey showed.