The rebound in China’s steel prices seen during this month is expected to extend to December, supported by resilient steel demand from both domestic and international markets, as well as firming raw material prices, according to Mysteel’s chief analyst Wang Jianhua.

Domestic steel prices have posted firm gains in the past few weeks, as Mysteel’s assessment of the national composite steel price sat at Yuan 4,218.58/tonne ($597.7/t) including the 13% VAT as of November 28, rising 3.9% from October 31 and hovering around a seven-month high.

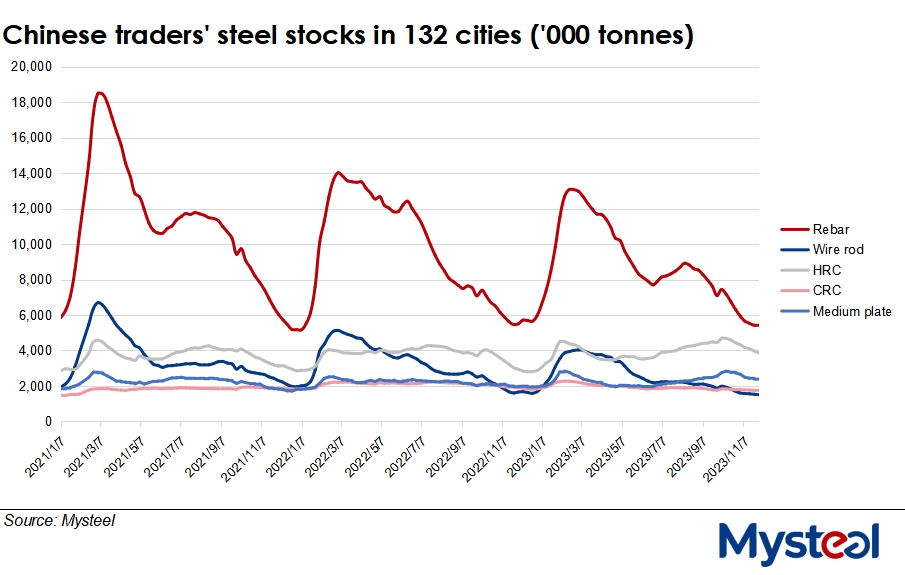

Total inventories of the five major carbon steel products have been steadily drawing lower this month, Mysteel’s survey showed, with the stocks held by 184 steel mills and trading houses across the country losing 1.7 million tonnes or 11.3% from end-October to reach 13.1 million tonnes by November 24.

“This means the ample steel supply that had caused some anxiety among market participants has been well absorbed by end-users,” Wang pointed out, adding that active exports continued to make a strong contribution to China’s steel consumption.

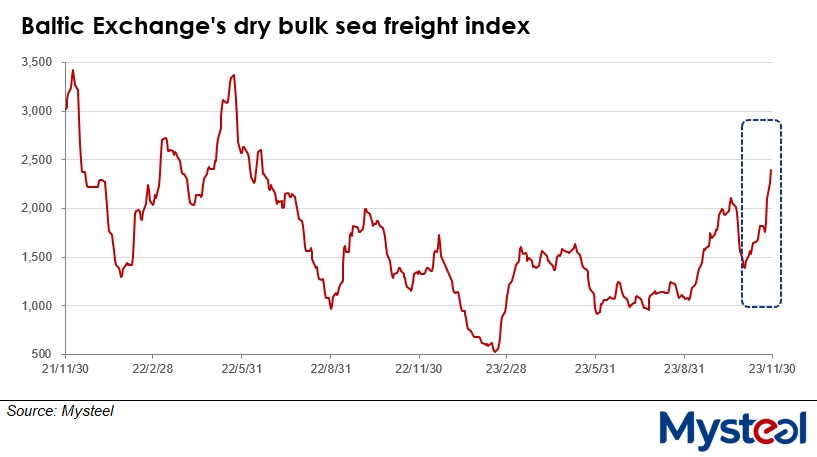

The increase in the Baltic Exchange’s dry bulk sea freight index (BDI), an indicator of supply-demand fundamentals in global dry cargo markets, has been reflected in the fact that international commodity trading is active, Wang observed. “The BDI is likely to stay on the rise in the near term too, which will keep supporting China’s steel exports,” he noted. By November 28, the BDI had settled at 2,391 points, jumping 53% on month to touch the highest level since June 22 last year, Mysteel Global noted.

Besides, “the recent rises in China’s interbank lending rates indicate that capital needs are recovering in domestic markets, which means domestic enterprises’ operations have turned more active,” Wang added, noting that this is likely to drive up domestic steel demand. On the other hand, steel supply in China may shrink slightly in December under the production curbs mandated by governments aiming to ease air pollution in winter, according to Wang. As such, the domestic steel-market fundamentals “will not exert much pressure on steel prices next month”, he predicted.

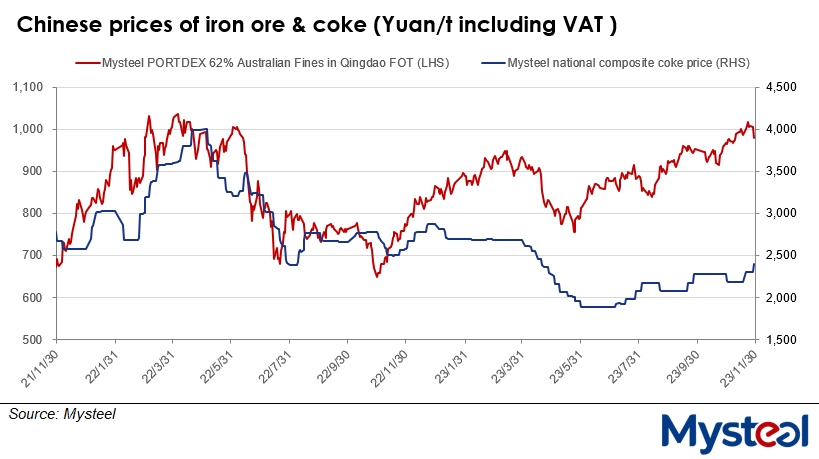

The rise in production costs is also expected to be a driving force behind Chinese steel prices going forward, Wang believed, since the prices of steelmaking raw materials such as iron ore and coke are following an upward trend. For example, Mysteel PORTDEX 62% Australian Fines in Qingdao hit a 19-month high on November 22 of Yuan 1,016/wmt FOT and including the 13% VAT, higher by 5.3% from October 31, though the index retreated to Yuan 979/wmt by November 28 due to the government’s frequent attempts to crack down on price speculation, as reported.

Meanwhile, China’s metallurgical coke market has witnessed two successful rounds of price increases totalling Yuan 200-220/t so far this month, and coke producers are expected to initiate another hike soon due to the persistently high prices of coking coal, as reported. By November 28, China’s national composite coke price had risen by Yuan 202.4/t from October 31 to reach Yuan 2,395.1/t including the 13% VAT, according to Mysteel’s assessment.

As a result, the costs for making steel incurred by Chinese steel mills are likely to rise by Yuan 150-200/t in December, and will “quite probably” prompt the mills to lift their steel selling prices by another Yuan 100-200/t next month, Wang believed.

Inventories of the five major steel items held by Chinese traders under Mysteel’s tracking decreased for the eighth successive week during November 24-30, falling by another 156,300 tonnes on week, according to Mysteel’s latest survey. But the size of the decline was half that of the on-week drop of 316,500 tonnes in the previous survey period, as long steel demand shrank further with the weather turning chilly in more parts of the country while steel mills’ production kept rising.

The stocks of rebar, wire rod, hot-rolled coil (HRC), cold-rolled coil and medium plate in traders’ warehouses in the 132 cities Mysteel monitors nationwide thinned by 1% on week to 14.9 million tonnes as of November 30, refreshing an intra-year low, the survey result showed. However, the pace of the decline slowed by 1.1 percentage points from the prior week.

Within the totals, HRC stocks declined the most among the five, shrinking by 110,200 tonnes on week to 3.9 million tonnes as of Thursday. In contrast, rebar stocks inched down by just 2,700 tonnes on week to 5.4 million tonnes, as against the 108,600 tonnes-fall in the prior week, Mysteel’s data showed.

“Traders felt the rising stress of trying to sell their tonnage at hand, as more deliveries of steel products arrived in the market just as steel consumption was slackening further due to winter,” said a market insider in East China’s Zhejiang.

The total output of the five steel items at the 184 Chinese steel mills Mysteel checks grew for the third straight week over November 23-29, rising by another 1.2% or 109,940 tonnes on week to reach a 1.5-month high of 9.2 million tonnes. Long steel demand from end-users weakened from the previous week, as the trading volume of construction steel items comprising rebar, wire rod and bar-in-coil averaged 139,523 tonnes/day over November 23-29, lower by 9.4% or 14,600 t/d on week, according to Mysteel’s survey among 237 traders’ warehouses it monitors across the country.

Meanwhile, steel inventories held by traders in Mysteel’s former smaller sample across just 35 cities declined further but also more slowly, easing by 1% or 94,100 tonnes on week to 8.9 million tonnes as of November 30. The on-week decline was 1.8 percentage points slower than that in the previous period.