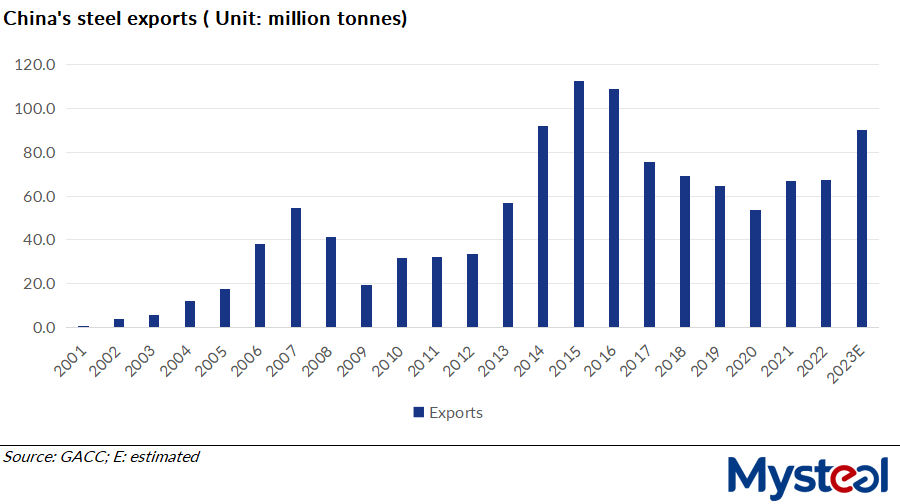

China’s steel exports are expected to exceed 90 million tonnes in 2023, while steel imports may reach about 7.6 million tonnes, according to the latest monthly report released by the China Iron and Steel Association (CISA) on January 3.

Notably, the accumulative exports tonnage in 2023 will be only below those in 2014, 2015 and 2016, CISA stressed.

The price advantages generally enjoyed by Chinese steel products in the international steel market remained the major reason buoying the export tonnage, the release explained.

For example, as of December 29, the export price of Chinese SS400 4.75mm hot-rolled coil was assessed by Mysteel at $575/t FOB from North China’s Tianjin port, lower by $30/t compared with Japan-origin offers posted the same day, according to Mysteel’s survey.

For November alone, China’s steel exports reached 8.01 million tonnes, higher by 0.8% from October but surging by a large 43.2% compared with November 2022, the CISA monthly report noted. The result was also in line with the data released earlier by China’s General Administration of Customs (GACC) on December 7.

Of these, the exports of steel items such as wire rods, welded tubes and hot-rolled strips witnessed substantial growth last month, and steel exports to Vietnam and Saudi Arabia rose quickly.

Meanwhile, the average export price of Chinese steel was settled at $810.9/tonne in November 2023, inching up by 2.4% on month but dropping by 38.4% on year, CISA added.

Over January-November 2023, China’s steel exports jumped by 35.6% on year to reach 82.66 million tonnes, while the average export price during the same period stood at $947.4/t, plunging by 32.2% on year, CISA data showed.

However, it’s worth noting that due to the expansion of China’s steel export volumes, five countries around the world have initiated six trade remedy investigations against steel products imported from China in 2023, and by the year end, Mexico announced a nearly 80% tariff on certain steel products from China. Chinese steelmakers need to be vigilant about the increasing risk of trade frictions, the association warned.