Met Market Update

Why is met rallying? Supply has become incrementally tighter and demand coming out of the summer doldrums is picking up again.

Why is met rallying? Supply has become incrementally tighter and demand coming out of the summer doldrums is picking up again.

Why is Alliance trading at a market premium to Australian thermal coal producers? It makes no sense in terms of long-term shareholder value.

Herewith a quick rundown on Chinese Leading Indicators, PMI’s, and Steel Production. Plus metallurgical coal and iron ore implications.

Time to address the elephant in the room. Whitehaven is most likely going to buy Blackwater and Daunia from BHP.

Thinking through the poor relative performance of Ramaco vs the peer group, and I think the situation is going to get worse from here.

US domestic met coal market is currently facing several challenges, with the UAW strike looming on the horizon.

We’re beginning to see the inadequacy of Chinese coal production to meet their own power demands as production falters & demand climbs.

The following report published by a Chinese investment bank, Cinda Securities, contains some inside baseball on the Chinese coal industry.

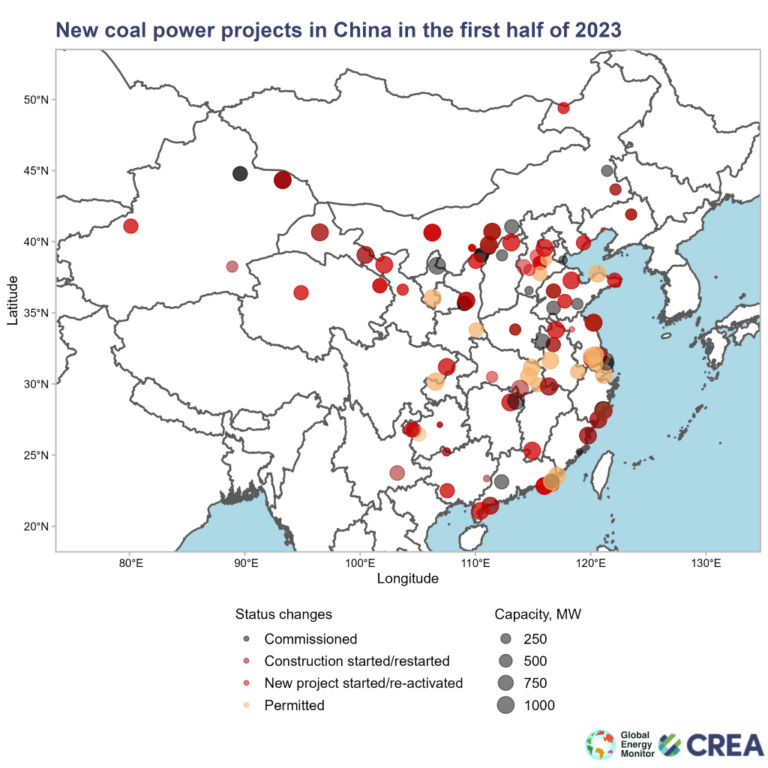

In the first half of 2023, China approved 52 GW of new coal power projects, a significant increase from the 15 GW permitted in H1 2022

I’ve been working on summarizing Alliance & CONSOL for the website & it got me thinking about both companies from a compare and contrast point of view

Lets go through BHP’s Economic and Commodity Outlook, pull out/summarize the important highlights and provide my thoughts on various topics.

The action in the uranium markets today is hard to ignore. The price of uranium appears to be