Met Coal Market Update 4/15/25

Lots going on in today’s price update, so we provided a full post…

Lots going on in today’s price update, so we provided a full post…

Coking coal markets are caught in a tug-of-war between mounting trade tensions and persistent supply disruptions, with recent price action reflecting just how quickly sentiment can swing…

You must be logged-in to see this content. Logged-in Premium subscribers get full access to this page. If you’re a subscriber but haven’t logged in,

A Pennsylvania bankruptcy court has approved the $15 million sale of key assets belonging to Corsa Coal to Rosebud Mining Company…

Moranbah North, one of Queensland’s largest underground coal mines, has halted production following the detection of elevated carbon monoxide levels…

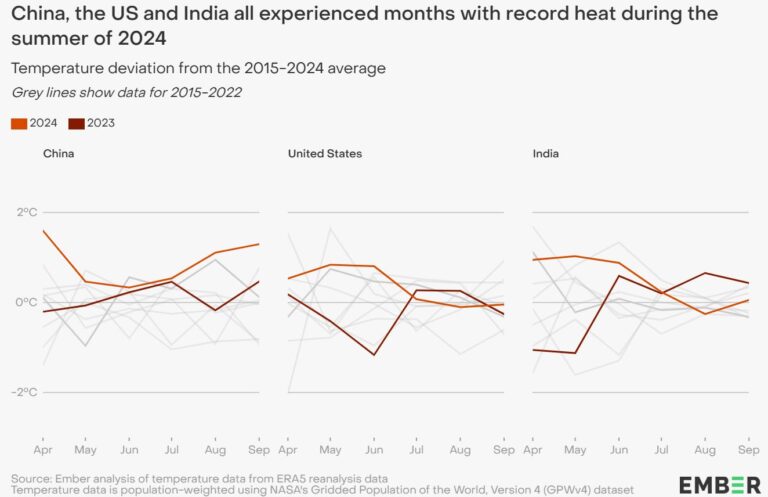

India is preparing for a record peak power demand of 270 gigawatts (GW) in the summer of 2025, according to forecasts by the Central Electricity Authority (CEA). That would be 20 GW higher than the record high recorded last summer…

Coal production in Russia’s key mining region of Kuzbass fell slightly in the first two months of 2025, as logistical constraints and economic pressures continue to weigh on the country’s coal sector…

An overview of China’s latest stimulus measures…

A slightly longer update than our usual posts on thermal coal markets…