Canada has emerged as one of the exporters with the biggest increase in seaborne coal exports during 2023, with the upwards trend maintaining momentum in 2024 as well. In its latest weekly report, shipbroker

Banchero Costa said that “global coal trade has really picked up pace in recent months, and is now fully back to pre-Covid levels. In Jan-Dec 2023, global seaborne coal loadings increased by +5.8% yo-y to 1,339.5 mln t (excluding cabotage), based on vessel tracking data from AXS Marine.

In Jan-Feb 2024 the positive trend continued, with global coal loadings increasing by +9.3% y-o-y to 213.9 mln t, from 195.6 mln t in the same period last year. In Jan-Feb 2024, exports from Indonesia increased by +17.4% y-o-y to 83.7 mln t, whilst from Australia were up +16.6% y-o-y to 56.4 mln t. From Russia exports declined by -18.2% y-o-y to 23.4 mln t in Jan-Feb 2024, from the USA increased by +1.1% y-o-y to 13.9 mln t, from South Africa increased +6.0% y-o-y to 10.2 mln t. Shipments from Colombia increased by +19.0% y-o-y to 9.5 mln t in JanFeb 2024, from Canada by +3.3% yo-y to 7.4 mln t, and from Mozambique down by -18.6% t-o-y to 2.8 mln t.

According to Banchero Costa, “seaborne coal imports into Mainland China increased by +22.7% y-o-y to 57.9 mln t in Jan-Feb 2024, to India increased by +24.9% y-o-y to 39.0 mln t, to Japan declined by -13.3% yo-y to 26.0 mln t in Jan-Feb 2024, to South Korea increased by +0.7% y-oy to 20.7 mln t, to the EU down -45.6% y-o-y to 11.1 mln tonnes.

Canada is the seventh largest exporter of coal in the world. In 2023, Canada accounted for 3.4% of global seaborne coal shipments. Canada’s seaborne coal exports in the 12 months of 2023 increased by +9.6% y-o-y to 49.9 mln tonnes. This followed a decline of -0.9% y-oy in 2022, and a +7.1% y-o-y increase in 2021”.

“In the first 2 months of 2024, coal exports from Canada increased further by +3.3% y-o-y to 7.4 mln tonnes, from 7.1 mln t in Jan-Feb 2023, and 6.7 mln t in Jan-Feb 2022.

Nearly half of the coal produced in Canada is thermal and half is metallurgical. Canada’s exports are primarily metallurgical coal. Alberta and British Columbia produced 85% of Canada’s coal. Canada exports about half of its coal production. Given the location of its mining resources, the overwhelming majority of Canadian coal exports are shipped from ports in British Columbia, on the Pacific coast.

Of the 49.9 mln tonnes shipped in calendar 2023, 85% (42.4 mln tonnes) were shipped from Vancouver (including Roberts Bank), and 13.2% (6.6 mln tonnes) from Prince Rupert. In terms of vessel types, 40.1% of coal loaded in Canada in 2023 was shipped on Capesize vessels, 35.6% on Post-Panamax tonnage, and 22.1% on Panamax tonnage”, the shipbroker said.

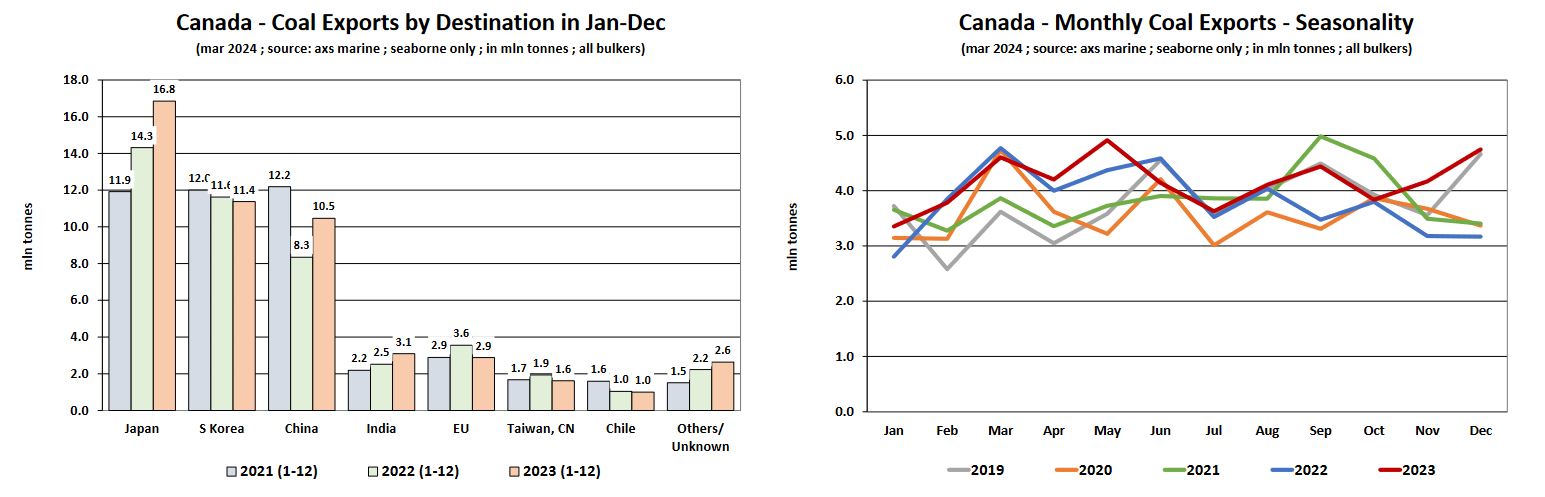

Banchero Costa concluded that “the vast majority of Canada’s coal exports go to Asia, which is still a significant consumer. In 2023, as much as 33.8% of Canada’s seaborne coal exports were shipped to Japan. In Jan-Dec 2023, coal exports to Japan from Canada increased by +17.6% y-o-y to 16.8 mln tonnes.

The second largest destination for Canadian coal is South Korea, accounting for 22.8% of Canada’s exports in 2023. In 2023, exports from Canada to South Korea declined by -2.1% y-o-y to 11.4 mln tonnes. In third place is Mainland China which accounted for a 21.0% share in 2023.

In 2023, shipments from Canada to China increased by +25.4% y-o-y to 10.5 mln tonnes. In fourth place was India, with a 6.2% share of Canada’s coal exports. In 2023, 3.1 mln tonnes of coal were exported from Canada to India, up +22.8% y-o-y. In fifth place was the EU, with a 5.8% share of Canada’s coal exports. In 2023, the EU imported 2.9 mln t from Canada, down -18.8% y-o-y”.

Source: Hellenic Shipping News