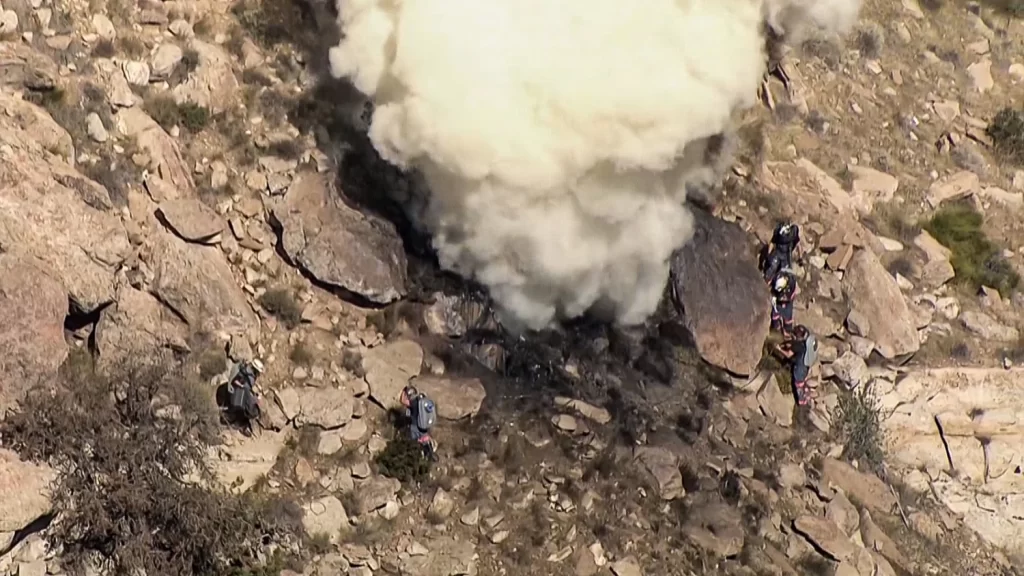

While Whitehaven Coal’s C-suite celebrates taking the keys at BHP and Mitsubishi’s $6.4 billion Daunia and Blackwater coal mines this week, suitors vying for a piece of the latter have been hard at work ahead of binding bids.

Street Talk understands Whitehaven has received at least three non-binding indicative bids from strategics keen to get their hands on a 20 per cent slice of the Blackwater metallurgical coal mine in Queensland’s Bowen Basin. The stake is expected to be worth about $US500 million ($768 million).

Indian steelmaker JSW has submitted a proposal, and would be competing against a Japanese bidder and an Indonesian entity in the auction’s final stage. Of note, Tokyo and Osaka headquartered conglomerate Itotchu has kept close to Whitehaven since the original auction’s early days, with hopes of being cut into the deal later. European bank HSBC’s Asia-based investment banking team is understood to be sticking close to one of the bidders.

Sources said suitors were told to think about one board seat and a 20 per cent stake in the operating joint venture, with Whitehaven controling the rest. This has kept the miner’s ASX-listed rivals away from the auction, shrinking down the crowd of tyrekickers to just three key bidders.

The winning bidder will essentially be a silent partner on the mine. It would receive a share of the profits, but would have to defer to Whitehaven on key decisions. Sell-side adviser UBS collected non-binding indicative bids in mid-March ahead of deal completion on April 2, as flagged by this column.

From here, Whitehaven and UBS should be able to make quick business of the auction. Bidders know Blackwater well, including its rehabilitation liability; there’s a price marker from the original deal; and Whitehaven has been clear about what it wants in a partner.

Whitehaven has not publicly disclosed Blackwater’s valuation, but sources suggest the mine is worth more than $US2.5 billion. That implies a 20 per cent stake would be worth around $US500 million. The bidders are expected to push for a discount, given they won’t have a controlling stake. The mine is Bowen Basin’s No. 2 open-cut met coal producer, with plans to produce an average of 14.8 million tonnes of saleable met coal annually for the next five years.

Whitehaven funded its circa $6.4 billion purchase of Blackwater and Daunia without subjecting shareholders to a large equity raise. Instead, it cut back on dividends and lined up $US900 million from private debt giants including Ares Management, Canyon Partners and Farallon Capital.

By Sarah Thompson, Kanika Sood and Emma Rapaport

Source: AFR