Vessel traffic in an out of the Port of Baltimore, Maryland, has been suspended indefinitely in the wake of a container ship collision early today that brought down the Francis Scott Key Bridge, an accident that will force the rerouting of coal, car and light truck shipments.

The prolonged closure of one of the largest ports on the US east coast could have a ripple effect on trade flows across much of the US, as shippers grapple for alternatives in the absence of a certain reopening timeline.

Search and rescue efforts are still ongoing in the Patapsco River, after the 116,851dwt Dali headed to Colombo, Sri Lanka, slammed into a bridge support. The crew had lost control of the vessel. The Dali is owned by Grace Ocean and managed by Synergy Marine Group.

The Maryland Port Administration said it does not know how long it will take for the shipping channel to be cleared and for traffic to resume. Shipping companies are bracing for a closure of at least two weeks, but many expect the clean-up effort could take significantly longer.

President Joe Biden vowed the federal government will provide whatever resources are needed to get the port “up and running again as soon as possible.”

The port is a major trade hub for steam and coking coal, automobiles and scrap metal. Many market sources are still trying to determine whether the disruption will be dramatic enough to move prices.

But coal markets were already being affected today.

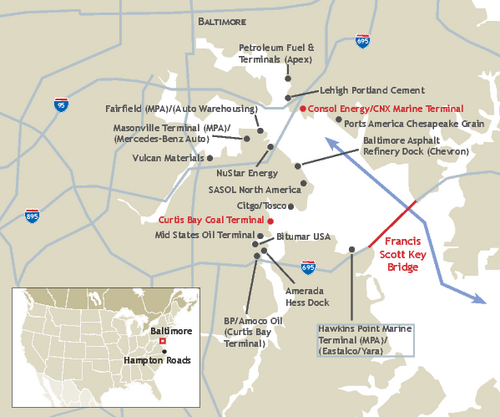

Baltimore is home to two key coal export terminals: eastern US railroad CSX’s Curtis Bay Coal Piers and coal producer Consol Energy’s Consol Marine Terminal. The facilities are upstream of the bridge, meaning ships will not be able to serve them until the route reopens.

The terminals handle thermal and coking coal from Northern and Central Appalachia. They have a combined export capacity of 34mn short tons (30.8mn metric tonnes). The two terminals loaded 2.4mn t of coal in February, up from 2.1mn t a year earlier, according to analytics firm Kpler, mostly exports to India and China.

An India-based trader said that the suspension of coal exports will probably raise prices in India, as brick kilns enter the peak production season in the summer. Buyers could look to petroleum coke as a substitute, but the higher sulphur content may not be appealing to some users despite the higher calorific value.

Prices for deliveries to northern Europe are also likely to rise given that the Netherlands, Germany and Belgium combined are the second-largest market for North Appalachian coal. April API 2 futures rose by $2/t to $113.30/t. The incident has added a “level of volatility [which] could have big implications,” a European paper broker said.

The lack of information has prompted some coal producers to hold off on activating force majeure clauses in their contracts.

Curtis Bay is served only by CSX, while CSX and fellow eastern carrier Norfolk Southern serve Consol.

CSX said it is in contact with existing coal customers and contingency plans are being implemented. The railroad at this point intends to keep Curtis Bay open but will continue to assess the circumstances moving forward. Norfolk Southern did not respond to questions.

Some scheduled Baltimore coal exports may be redirected to the other three eastern US coal export terminals in Hampton Roads, Virginia, but such reroutings likely will entail increased costs.

Not all coal mines will be able to shift terminals. Such decisions will depend on available capacity in Hampton Roads. Exports from the three terminals in January reached a five-year high, signaling somewhat limited capacity.

Mine location and railroad access may also determine whether coal can be rerouted, an industry source said. But some producers do not have much of a choice about trying to send coal to Hampton Roads. They may need the cash so will be forced into a decision.

The producers most vulnerable to delays may be Consol and Arch Resources. Arch’s Leer coking coal mine may be in the best position because it co-owns Dominion Terminal Associates in Hampton Roads with Alpha Metallurgical Coal Resources.

The sudden lack of export capacity could put a floor under US coal prices, which have mostly been falling since last year amid low domestic demand. The competition to replace Baltimore coal exports could prevent further cuts, another coal trading source said.

Metals sources say the accident will have only isolated effects on the global ferrous scrap market, but many market participants are still assessing the situation. The port is the 10th largest ferrous scrap export port in the US, and over the last five years an average of 44,000 metric tonnes/month of ferrous scrap was exported from Baltimore, according to US Department of Commerce data.

But the port closure is likely to affect other freight. Baltimore is the nation’s top handler of automobile traffic.

Motor vehicles and parts accounted for about 42pc of all Baltimore port imports and 27pc of all exports, according to state data. The Port of Baltimore handled 847,158 cars and light trucks in 2023.

“It’s too early to say what impact this incident will have on the auto business — but there will certainly be a disruption,” said John Bozzella, chief executive of industry trade group Alliance for Automotive Innovation.

Dry bulk freight rates likely unaffected

Several sources told Argus Baltimore’s closure is unlikely to have a major impact on dry freight rates despite short-term interruptions to coal transports.

“We are in the shoulder months with less demand for thermal coal,” a shipbroker said, suggesting mild global temperatures means the collapse “may not have too much of an impact” on freight markets overall.

Vessel traffic in ports such as Charleston, South Carolina, and Savannah, Georgia, may increase on diversions from Baltimore.

Kpler identified 17 vessels that will likely be impacted because they are either in the Port of Baltimore or were expected to load there in the coming days.

By Abby Caplan, Gabriel Squitieri, Luis Gronda, Evan Millard and Brad MacAulay

Source: Argus Media