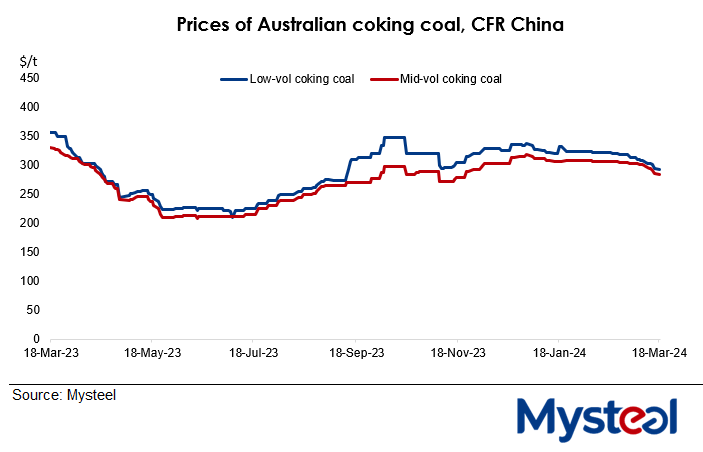

Prices for Australian metallurgical coal in China that have been weakening since early February have slid further in the past few days amid the softening demand of Chinese buyers, Mysteel Global has learned.

For example, the CFR China price of Australian premium low-volatile coking coal (A<10.5%, V<21%, S<0.6%, MT<10%, CSN>9%, CSR>70%) under Mysteel’s assessment had declined by another $2/tonne as of March 18 to hit a six-month low of $293/tonne after slumping by $6/t last Friday.

In parallel, the CFR price of Australian premium mid-volatile coking coal (A<10%, V<22%, S<0.6%, MT<10%, CSN>8%, CSR>65%) assessed by Mysteel also shed $1/t on March 18 to land at $285/t, making for a cumulative decline of $16/t since early last week. The price of hard Australian coking coal (A<8%, V<20%, S<0.5%, MT<10%, CSN>7%, CSR>60%) fell by a slightly larger $17/t during the same period, Mysteel’s data showed.

The stronger downward momentum for Australian coking coal prices stemmed from the subdued interest of Chinese steelmakers lately, as most mills are struggling financially due to the softening domestic steel market after the Chinese New Year holidays ended on February 18, Mysteel Global noted.

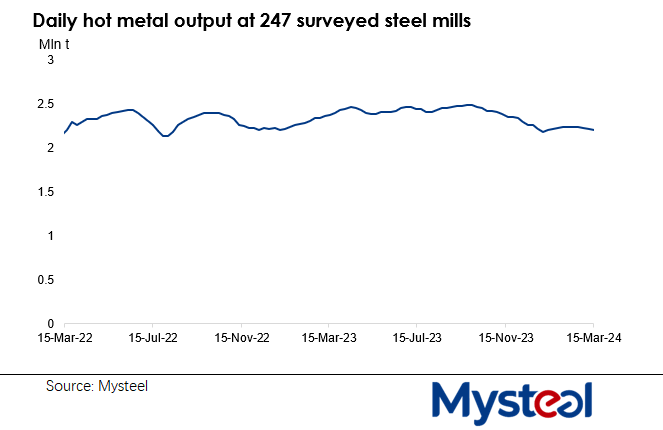

The Chinese mills’ sustained losses on finished steel sales have also forced many to curb their blast furnace operations, which in turn is impacting demand for Australian metallurgical coal, an industry insider said.

Mysteel’s data indicated that the daily output of hot metal among the 247 Chinese steel mills that it tracks nationwide has declined for four straight weeks since the week starting February 16, diving to a two-month low of 2.21 million tonnes/day on average over March 8-14.

Some domestic end-users among mills and coke makers have slowed their restocking pace for Australian coking coal due to their poor profit margins, though others were tempted by lower prices of some cargos lately, according to market sources.

In coming days, a further retreat in CFR China prices of Australian coking coal is likely, a market watcher predicted, citing persistent downward pressure on prices for Chinese domestic coking coal grades.

For example, as of March 18 the price of Anze low-sulfur primary coking coal (A<9.5%, V<20%, S<0.5%, GRI>85, CSR>68%) mined in Lvliang city of North China’s Shanxi province had declined to Yuan 1,950/t ($270.9/t) on EXW basis and with VAT included, a more-than-six-month low.

China’s coking coal market has also been battered by persistent sluggish sales. So far this month, the trading volume of Chinese coking coal in the auction market has fallen by a substantial 11.4% compared with January to average only 254,000 tonnes/day.

As a result, the declines in China’s coking coal prices have exacerbated the wait-and-see sentiment among domestic buyers of Australian coal cargoes, the prices of which are gradually losing attraction, Mysteel Global noted.

Indeed, on Tuesday some Chinese steelmakers began demanding that met coke suppliers cut another Yuan 100-110/t from their coke selling prices effective from March 20 – a factor that may negatively impact China’s domestic coking coal market and by extension, conditions for Australian coking coal.

Written by Tammy Yang