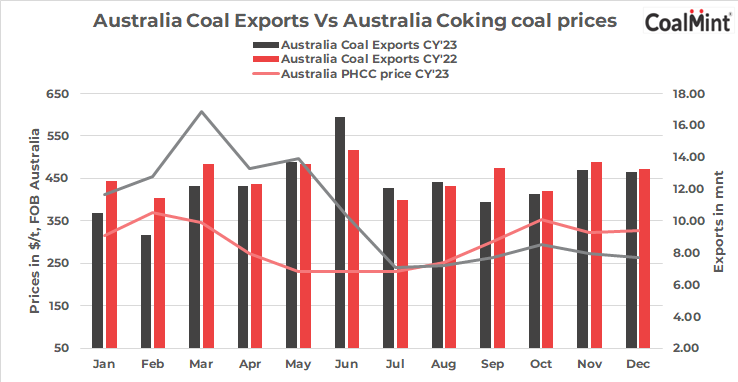

Australian coking coal exports dropped 4% y-o-y to 147.84 million tonnes (mnt) in CY’23 as against 153.48 mnt in CY’22. Australian exports fell in CY’23 amid weather challenges, inexpensive alternate origin material availability and mine suspensions.

Why did Australian exports fall in CY’23?

Exports fell on inexpensive alternate origin material availability

Coking coal exports from Russia and the US experienced a significant increase in CY’23. India and other top importers of coking coal are exhibiting a growing preference for Russian coking coal due to its lower cost compared to Australian alternatives. Russian coking coal exports to India doubled, reaching 4.90 mnt in CY’23, compared to 2.40 mnt in CY’22. This surge is attributed to substantial discounts offered by Russian suppliers following trade sanctions imposed after the Russia-Ukraine war.

SAIL announced plans to boost coking coal purchases from Russia. Since April 2023, SAIL booked about eight shipments from Russia.

Additionally, US coking coal exports saw an 11% increase in CY’23, rising from 42.10 mnt in CY’22 to 48.12 mnt. Notably, during January-March 2023, exports from the US surged by 8%, driven by supply constraints in Australia due to rainfall and cyclones.

Exports decline amid weather challenges and mine suspension

Australia’s coking coal exports due to heavy rains and floods disrupting supplies, particularly in northern and central Queensland. Shipments to key countries like India, Japan, and South Korea fell in first quarter of 2023 . In February, exports fell, facing short-term delays due to train derailments and Gladstone Port closure, pushing PHCC FOB Australia prices up.

Australian coking coal exports fell in September 2023, as operations were suspended at BHP Mitsubishi Alliance’s Peak Downs mine. The suspension was initiated by Resources Safety and Health Queensland due to two trucking incidents. The halt in truck operations impacted supply, contributing to a surge in spot PHCC prices. The suspension, resulting from safety concerns, has impacted one of Australia’s major coal mines, affecting exports.

Exports were impacted towards November 2023 as the Australian Rail Track Corporation (ARTC) initiated maintenance on the Hunter Valley line. This crucial railway connects Narrabri in central New South Wales to the port of Newcastle, facilitating the transportation of 40 mines in the Hunter Valley and Gunnedah Basin.

Australia coal exports stable m-o-m in December’23

Australian coal exports are nearly stable m-o-m to 13.08 mnt in December 2023 as against 13.18 mnt in November 2023. Imports to India were largely stable at 3.59 mnt in December 2023 as against 3.64 mnt in November 2023. Exports to south Korea and the Netherlands fell by 12% and 80% in December 2023. Shipments to Japan were up by 3% to 2.58 mnt in December 2023 as against 2.50 mnt in November 2023.

Country-wise exports

India, formerly the largest buyer of Australian coking coal, experienced an 11% y-o-y decline in imports at 40.61 mnt in CY’23, compared to 45.38 mnt in the same period last year. Indian buyers diversified their sources, increasing procurement from Russia and the US due to competitive prices.

China imports stood at 7.41 mnt in CY’23. China lifted an unofficial ban on Australia exports. All restrictions were lifted earlier in the 2023, initially imposed in the fourth quarter of 2020. However, China’s coal imports remained majorly stable in CY’23, the country increasingly turned to Mongolian coal. Mongolian coal exports to China surged by 85% to 47.41 mnt in CY’23, compared to 25.61 mnt in CY’22.

Qty in mnt

Shipments to Japan fell by 10% to 30.83 mnt in CY’23 as against 34.42 mnt in CY’22. Imports by South Korea and the Netherlands fell by 10% and 11% to 19.94 mnt and 8.89 mnt, respectively.

Exports to Indonesia surged by 39% at 5.41 mnt in CY’23 as against 3.89 mnt in CY’22. The significant rise in Australian coking coal exports to Indonesia can be attributed to its rapidly expanding industrial base. The thriving construction sector is emerging as a substantial contributor to the country’s gross domestic product.

Brazil (4.92 mnt) and Europe (3.15 mnt) experienced increase in imports from Australia by 79% and 35% in CY’23.

Australian coking coal prices CY’23 v/s CY’22:

Australian Premium hard coking coal prices in CY’23 fell by 18% y-o-y to $296.27 as against $363.02 in CY’22. Coking coal prices in Australia were higher in CY’22 compared to CY’23, influenced by the Russia-Ukraine war. The prices were at record high levels in CY22. However, it got corrected in CY’23.

Port-wise exports

Exports from DBCT rose 12% y-o-y to 43.29 mnt in CY’23 as against 44.62 mnt in CY22. Shipments from Gladstone stood at 43.29 mnt in CY’23 as against 44.62 mnt in CY’22. Supplies from Hay point and Abbot Point dropped by 10% and 19%, respectively, in CY’23.

Recent advancement:

Dartbrook coal mine set to restart operations

In a significant recent development, Australia’s Pacific Coal secured funding from Vitol Asia Ltd. to reopen the Dartbrook mine in New South Wales, closed since 2007. Plans of initial production from the Dartbrook site is in the first quarter of 2024 and the deal includes a sales and marketing agreement with Vitol.

Peabody to begin production at North Goonyella mine in Q1CY’24

Peabody Energy Corp. to commence production at North Goonyella mine (Centurion Mine) in Australia towards Q1CY’24. The mine was closed since 2018 due to fire accident. In October 2023, the company reached to an agreement to acquire Wards Well coal deposit, which will reweigh Peabody’s long-term production and revenue toward metallurgical coal.

Outlook

Australia’s coal exports might decrease in the first quarter of 2024, especially with heavy rainfall expected in the upcoming rainy season in Australia from January to March 2023. Observing past trends, major importing countries are shifting towards other sources of coking coal like Russia and Mongolia, where prices are comparatively inexpensive than in Australia. This shift might affect the market sentiments of Australian coking coal exports.