The operations among Chinese building contractors have been resuming gradually during the past few weeks after the Chinese New Year (CNY) holiday breaks, but the pace has been much slower than in previous years, Mysteel’s latest survey showed. The slower recovery has largely constrained domestic demand for long steel products, rebar and sections in particular, Mysteel Global learned.

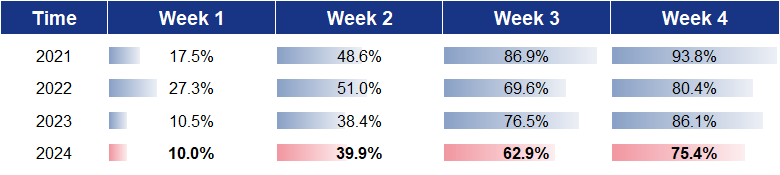

As of March 12, the fourth week past the CNY holiday, the average operational rate at the 10,094 construction sites Mysteel tracks across 187 leading construction enterprises nationwide averaged 75.4%, lower by a significant 10.7 percentage points compared with the same period after last year’s lunar year. Of the sampled sites, 27% are real estate projects, and the remaining 73% cover metro, high-speed railway, elevated highway, water engineering, and other construction projects.

Operational rate among sampled construction sites post CNY holiday

Meanwhile, the ratio of construction workers who had resumed normal work (as a percentage of the total workforce on projects) was 72.4% as of March 12, 11.5 percentage points lower compared with the fourth week after CNY last year, the survey results showed.

“The construction progress of existing projects is relatively slow, while the number of new starts decreased markedly this year,” a market analyst based in Shanghai observed, adding that the fund shortages remain the major impediment to the operations.

China has instructed 12 provinces and municipalities to postpone or suspend certain state-funded infrastructure projects to prevent further deterioration of their debt burdens, starting early this year. Following this, the approval of news construction projects in these regions has been stricter, and some projects with construction work exceeding 50% are shut down.

Dragged by the slower-than-expected building progress, the country’s consumption of construction steel products declined on a yearly basis, according to Mysteel’s survey. On March 12, the total trading volume of construction steel including rebar, wire rod and bar-in-coil among the 237 Chinese trading houses Mysteel tracks was 129,638 tonnes, lower by 8.5% on year.

The slack demand also placed heavy pressure on domestic steel prices, Mysteel Global noted. For example, China’s national price of HRB400E 20mm diameter rebar was assessed by Mysteel at a six-month low of Yuan 3,782/tonne ($533.6/t) including the 13% VAT on March 12.

In addition, the quantities of steel scrap recycled from construction sites across the country also decreased with the delay in construction progress, Mysteel Global noted. During March 4-8, the volume of construction steel scrap collected by the 10 domestic steel scrap recycling companies under Mysteel’s regular tracking totaled just 19,405 tonnes, hovering around the lowest level in the past year.

Despite the tight availability in the market, domestic prices of construction steel scrap were still following a downward trend due to the intensifying pessimism among market participants amid weak steel demand, Mysteel’s survey showed.

As of March 12, the national price of rebar cuttings stood at Yuan 2,692/t excluding the 13% VAT after falling for eight straight working days, according to Mysteel’s assessment.

Written by Anthea Shi at MySteel