- Power demand key coal consumption driver

- Thermal coal production may rise 9% y-o-y to 980 mnt in FY’25

- Imports may drop 20% y-o-y in FY’25 on govt. push

The phenomenal growth of the coal industry in India is primarily due to the exponential surge in power demand even as the industrial sectors have emerged as major consumers of coal amid rapid economic growth.

Total national demand for non-coking coal (thermal or steam coal) is expected to touch 1,128 million tonnes (mnt) in FY’25, up by around 3% from the expected consumption figure of around 1,098 mnt in FY’24, as per BigMint assessment.

Coal is majorly consumed for electricity generation in India (about 64%), followed by steel (8%, coking coal) and cement (5%). Coal is also consumed by various other industries such as paper, textile, fertilizers, railways, defense and other small and medium enterprises.

During FY’23 energy generated from coal accounted for about 73% of the total generation of energy in India followed by electricity from hydro, nuclear and other renewable sources (25%) and natural gas (1%), as per Ministry of Coal.

The country’s production of non-coking coal is expected to increase by 9% y-o-y to 980 mnt in FY’25 even as production is expected to touch 900 mnt in FY’24.

Sector-wise demand outlook

Coal-based utilities will emerge as the major consumers of thermal coal, with total demand touching 860 mnt in FY’25, up from 845 mnt in FY’24. Captive producers will account for a total consumption of around 158 mnt in FY’25, as per data, an increase from around 150 mnt in FY’24.

While coal consumption of the domestic cement industry should be around 46 mnt in FY’25, sponge iron producers will likely consume around 54 mnt of non-coking coal in FY’25, up from 50 mnt in FY’24.

Other sectors such as the fertilizer and paper industries are expected to consume around 10 mnt of non-coking coal by FY’25, marginally up compared with FY’24.

In FY’24, 60% of India’s non-coking coal imports are expected from Indonesia, while shipments from South Africa, at around 30 mnt, are likely to make up for 16% of total imports. Shipments from Australia, at 15 mnt, are likely to constitute 8% of total non-coking coal imports.

Outlook on imports

In line with the government’s fast-paced policy push toward import substitution, non-coking coal imports are expected to drop around 19% y-o-y in FY’25 to 150 mnt from 185 mnt in FY’24.

Demand for imported coal is from captive power plants, domestic coal-based power plants (DCB) and cement industries, which consume two-thirds of non-coking coal imports. Utilities based on imported coal (ICB) along the coastline account for the balance.

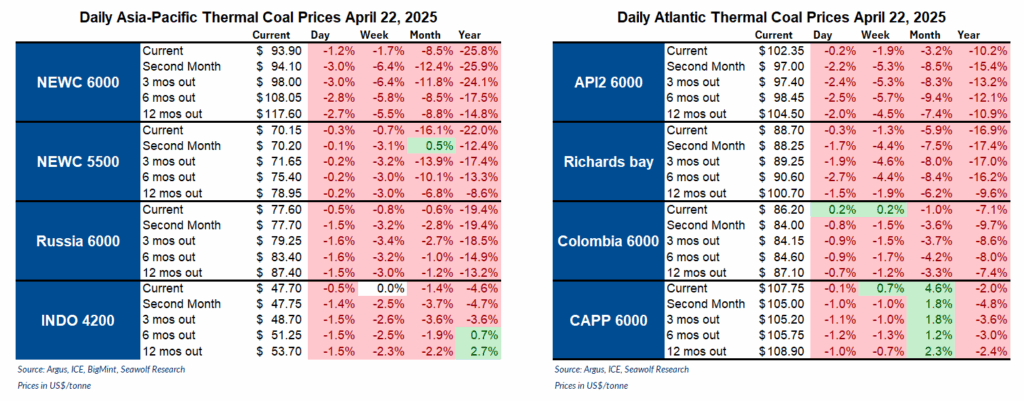

Source: BigMint