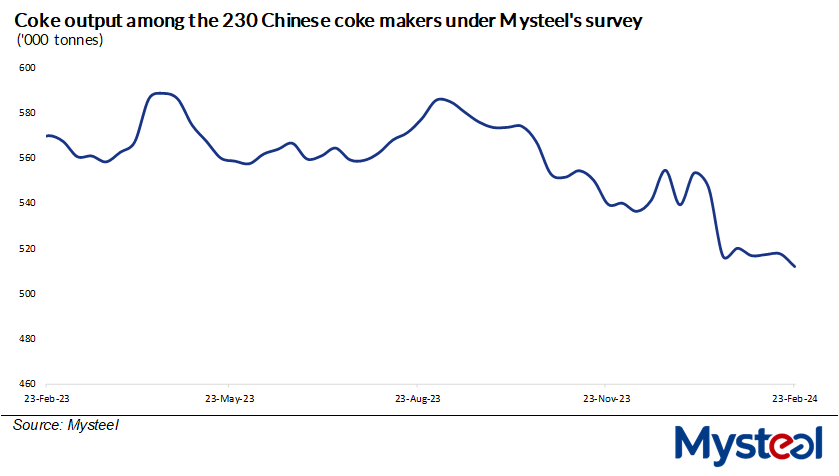

The total volume of metallurgical coke produced by the 230 Chinese independent coking plants in Mysteel’s weekly survey declined during February 15-21, slipping by 5,600 tonnes/day on week to average 511,800 t/d. The fall in coke production took the average to a 14-month low and reflected the fact that the coke makers were curtailing production to avoid further margin losses, according to industry watchers.

Mysteel’s other survey conducted among a smaller sample of 30 merchant coke producers nationwide showed that as of February 22, they were losing a large Yuan 107/t ($15/t) when selling their met coke – a more damaging dent to their bottom lines than the prior week’s average loss of Yuan 43/t.

The deeper losses came after domestic coke producers had conceded a Yuan 100-110/t price cut, bowing to demands from leading steelmakers in North China’s Hebei province and East China’s Shandong province for further selling price reductions on February 19. The cut that the coke makers were obliged to accept from their steel mill customers was the third this year and made for a total reduction of Yuan 300-330/t.

On the demand side, the appetite for coke among Chinese steelmakers stayed somewhat cool during the survey week as most seemed to be in a “wait-and-see-mode” after the Chinese New Year holiday. Most steel mills were hesitant about procuring coke in large quantities and only took small tonnage to fulfill their normal production needs, Mysteel Global learned.

The cautious mood among these mills was mainly because they were also suffering losses on their sales of finished steel. The margin losses, coupled with lukewarm demand from steel end-users amid the seasonal lull, have persuaded steelmakers to keep a tight rein on production. This in turn dampened their appetite for coke, Mysteel Global notes, giving them some confidence to demand coke-price concessions.

For example, average hot metal production among the 247 Chinese steelmakers Mysteel regularly tracks fell by 10,400 tonnes/day over February 16-22 to an average 2.24 million t/d – an indication that their appetite for feed coke has declined.

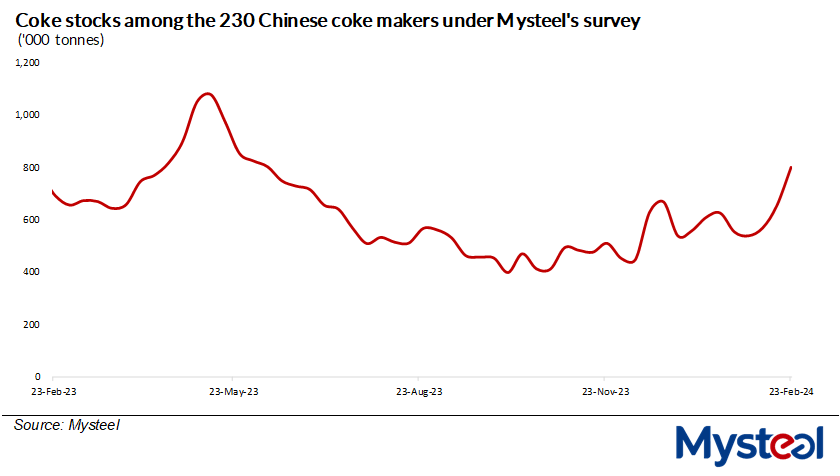

The slackening of coke procurement among steel mills, together with transport disruptions caused by heavy snows in some regions of North China during the survey week, have pushed coke stocks at plants higher.

Total coke inventories among the 230 surveyed coking plants leapt by a large 145,200 tonnes or 22.1% on week to hit an eight-month high of 801,200 tonnes as of February 22, according to Mysteel data.

As of February 22, China’s national composite coke price under Mysteel’s assessment was lower by Yuan 98.6/t from pre-holiday level at Yuan 2,206.4/tonne including VAT.

Written by Winnie Han