Exxaro Resources Ltd. Chief Executive Officer Nombasa Tsengwa is sharpening the South African coal producer’s diversification strategy, after failing to acquire new mining and energy assets. The Johannesburg-based company made it onto a shortlist for buying a copper mine in Botswana last year, but was ultimately outbid by China’s MMG Ltd., which acquired the Khoemacau project for $1.9 billion.

“Those copper assets are extremely difficult to come by,” Tsengwa said in an interview on the sidelines of the Mining Indaba in Cape Town. “And the Chinese are beating us in the game.”

Exxaro, founded in 2006 on coal, zinc and titanium assets that were partly split from a unit of Anglo American Plc, started diversifying more than a decade ago. It’s built wind farms and is looking at other clean power projects as South Africa transitions away from coal and businesses look to cut their dependence on the erratic power supplies provided by state-owned utility Eskom Holdings SOC Ltd.

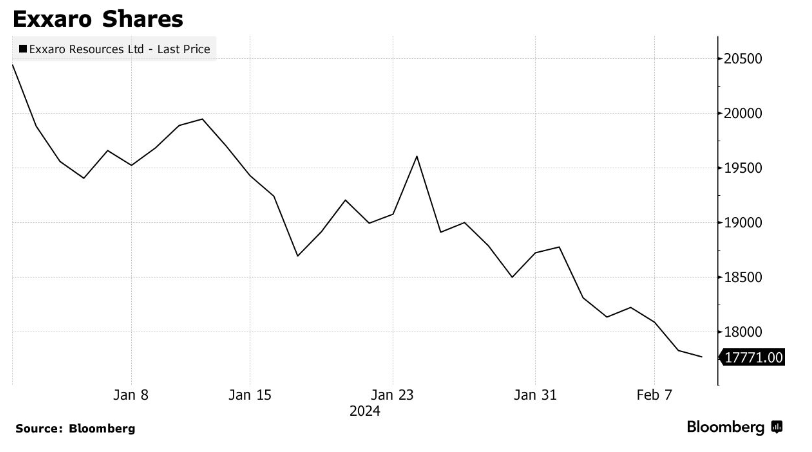

Shares of Exxaro have slipped 13% in Johannesburg this year as prices for the dirtiest fossil fuel slumped.

The future of coal looks secure for up to 10 years but after that it becomes uncertain, according to Tsengwa. Still, the CEO is not going to rush the process as Exxaro seeks both additional energy assets as well as entry points into the metals that are key for the green transition.

“We are not going to just go crazy for the sake of chasing a target,” she said.

Exxaro in 2022 considered bidding for BTE Renewables, a company with solar and wind projects, people familiar with the matter said at the time. Engie SA and private equity firm Meridiam SAS went on to buy the firm in a $1 billion deal.

Companies with a pipeline of projects and high potential for growth would be preferred over owning existing generation assets, according to Tsengwa. Considering targets that range from energy to minerals will require a unique balance, the CEO said.

“The story of funding and financing and cost of risk is completely different,” she said.