Chinese prices of metallurgical coal are expected to hold largely steady until mid-February as market trading will gradually slip to a standstill over the Chinese New Year (CNY) holiday spanning February 10-17, according to Mysteel’s latest monthly report on the commodity. Meanwhile, for the rest of the month, prices are forecast to fluctuate within a narrow range due to the weakness of both supply and demand, the report said.

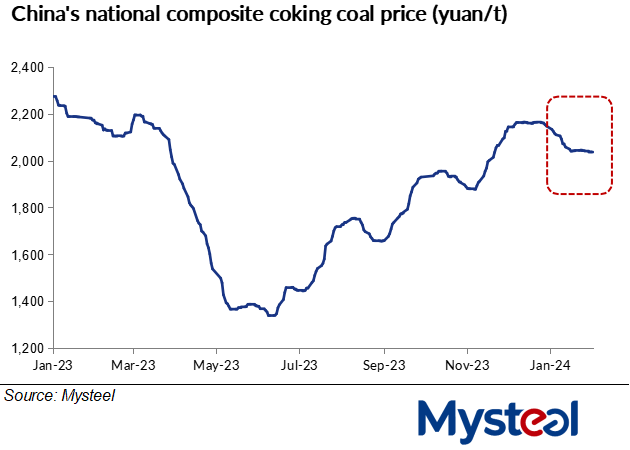

In January, China’s coking coal prices had fallen rapidly in the first half of the month, trailing weakening met-coke prices, the report noted. Met coke prices had declined by Yuan 200-220/tonne ($27.9-30.6/t) in response to pressure on sellers by the steel mills, as Mysteel Global reported.

As of January 16, China’s national composite coking coal price under Mysteel’s assessment stood at Yuan 2,042.3/t including the 13% VAT, falling by a marked Yuan 92.8/t compared with Yuan 2,135.1/t on January 2. But since then, the decline in coking coal prices has slowed, with China’s national composite coking coal price assessed by Mysteel at Yuan 2,038.4/t on January 31, only Yuan 3.9/t lower.

Besides the slower decline in coking coal prices, market fundamentals also improved, the report pointed out.

Specifically, coking coal supplies in China started to shrink late last month, not only as domestic coal mines were gradually shutting down for the upcoming holiday, but also as a result of a sudden production suspension of coal mines in Pingdingshan city, in Central China’s Henan, after a fatal coal mining accident there triggered safety checks by government authorities, as reported.

On the demand side, however, coke producers and steel makers were preoccupied with purchasing large quantities of coking coal for inventory building to ensure they could maintain stable production during the approaching holiday. Consequently, the robust restocking demand against the backdrop of tight supplies lent some support to met coal prices, preventing these from slipping sharply, the report concluded.

By February 1, coking coal stocks held by the 230 independent coke firms Mysteel monitors had touched a 23-month high at 11.7 million tonnes, while those nursed by the 247 steel mills under Mysteel’s tracking had risen for the fifth straight week, reaching 8.91 million tonnes, according to Mysteel’s data.

Lately, heavy snows have swept across the northern parts of China, where the country’s main coking coal mining areas are located. The adverse weather has disrupted road freight, sources revealed, but the impact is limited as trading in the met coal market is already receding with the CNY holiday only one week away.

Most coking coal mines aiming to close for the break have plans to resume production after February 17, the last day of the holiday, according to Mysteel’s survey. However, these mines intend to keep their capacity utilisation rates at a relatively low level in response to the likely stricter safety checks preceding the annual “Two Sessions” series of important political meetings to be convened in Beijing soon after on March 5, the report explained.

For this reason, the supplies of coking coal are likely to shrink, while demand for the steelmaking material could also stay subdued as mills still suffer losses on steel sales, the report cautioned. Among the 247 mills Mysteel regularly checks, only 25.97% of them managed to secure some profits on sales on February 1, down by another 0.44 percentage point on week, Mysteel’s data show.

In this scenario, domestic coking coal prices are expected to stay rangebound after the CNY holiday, according to the report.