Chinese steel prices will likely face downward pressure on multiple fronts this month as the mismatch between domestic steel supply and demand is becoming evident, according to Mysteel’s chief analyst, Wang Jianhua. At the same time, raw materials prices may retreat, he warned in his latest monthly report.

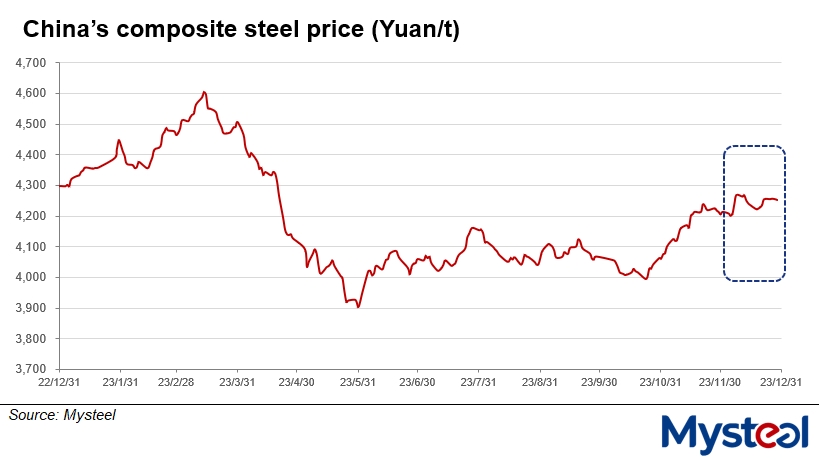

Domestic steel prices experienced mild increases last month as market participants were optimistic about the Chinese economy, Mysteel Global noted. As of December 29, the last working day of 2023, China’s national composite steel price was assessed by Mysteel at Yuan 4,251.89/tonne ($598.2/t), higher by Yuan 46.08/t on month.

However, bullish sentiment is likely to be overshadowed by weakening fundamentals for steel this month, according to Wang. “Steel demand is set to wane overall in January,” he predicted.

The decline in steel consumption will be most significant in the building sector, due to tight liquidity among construction companies and adverse weather conditions in winter, Wang explained, while steel demand from the manufacturing industry will also weaken moderately.

Meanwhile, “judging from the production plans revealed by some leading steelmakers, they will not cut output much in January, so steel supply will remain at a relatively high level this month,” Wang added.

During December 22-28, the average capacity utilization rate among the 247 blast-furnace (BF) steelmakers under Mysteel’s survey was 82.75%, slightly higher by 0.16 percentage point than during the same period last year.

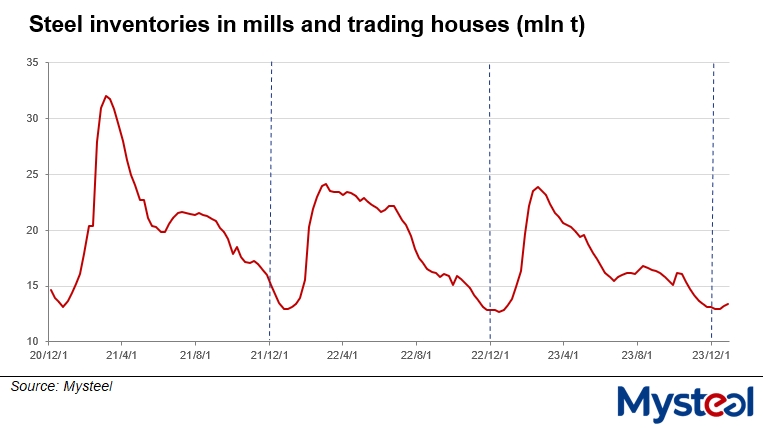

As a result, steel inventories will keep swelling throughout the country, becoming a drag on steel prices, Wang warned. “Steel stocks have grown for three consecutive weeks since early December, which happened a little earlier than in previous years,” he said.

By December 28, total inventories of the five major carbon steel products held by the 184 steel mills nationwide and trading houses in 35 domestic cities under Mysteel’s tracking had mounted to 13.4 million tonnes, higher by 293,100 tonnes or 2.2% on month.

“Inventories will rise at a faster rate this month, and the volume may grow by more than 2 million tonnes in total,” Wang predicted.

On the other hand, there is a risk that the high prices of steelmaking raw materials at present will decline, which in turn will also threaten the steel price performance, according to Wang. Mysteel PORTDEX 62% Australian Fines in Qingdao, for example, settled at Yuan 1,040/wmt FOT and including the 13% VAT as of December 29, hovering around the highest level since early September 2021.

“As steel demand is waning and most steelmakers are still suffering negative margins, it’s only a matter of time before raw material prices retreat,” Wang observed, noting that the cost support for steel prices will soften.

Mysteel’s survey showed that during the last week of December, only 28% of the 247 sampled BF steelmakers managed to earn some profits when selling steel, 11 percentage points lower than at the end of November.

Nevertheless, “the wide-ranging losses may in turn make steelmakers hold more firmly to their selling prices to avoid losing more money,” Wang said. “It is also likely to force some mills to scale back production at a faster pace, which may slightly ease the pressure on steel prices caused by ample supply,” he added.