China’s coal industry has experienced significant fluctuations in recent years, not only in terms of prices but also in production capacity. The transition from the previous capacity elimination to the present capacity enhancement for supply security appears contradictory at first glance but makes sense in terms of supply-demand dynamics.

Is capacity elimination still ongoing? What is the current state of China’s coal production capacity, and how much room is left for further expansion?

Capacity elimination

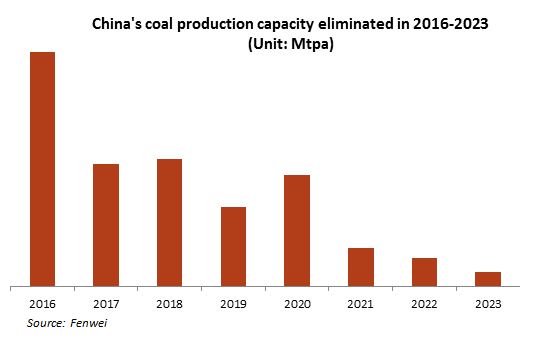

China’s State Council issued a document titled “Opinions on Resolving Coal Industry Overcapacity and Helping Enterprises through Difficult Times” in early 2016 to address issues including overcapacity and structural imbalance, marking the beginning of the supply-side reform in the coal industry.

During 2016-2017, China’s coal market experienced regional and periodic supply shortages due to production declines in the process of decapacity, making accelerating the release of high-quality capacity a crucial aspect of the 2017 coal supply-side reform.

In 2018, the focus shifted from total capacity reduction to systematic and structural optimization to improve industry structure and realize sustainable development.

Over 2019-2020, the emphasis was on closing mines with capacity below 300,000 tonnes per annum, expediting the exit of mines not meeting environmental standards, and reducing coal mines within nature reserves, scenic spots, and drinking water source protection areas.

From 2021-2023, while policies primarily focused on increasing production, maintaining supply stability, and stabilizing prices, capacity reduction policies still persisted. According to Fenwei’s statistics, a total of 21.08 million tonnes per annum of capacity was closed or phased out in 2023.

However, there are still numerous small mines with safety hazards in some areas. In the meantime, some coal mines are facing resources depletion and risks of shutdown, especially in provinces including Shanxi, Inner Mongolia, Henan, Anhui, and Shandong.

Capacity expansion

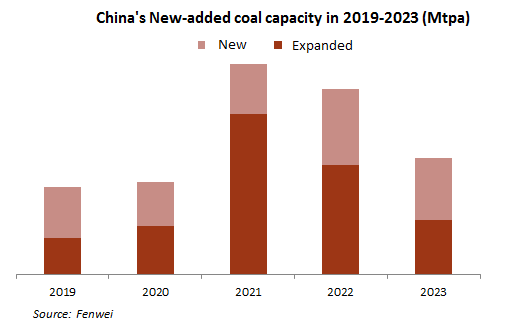

Starting in 2018, the Chinese coal industry transitioned from primarily reducing overall capacity to focusing on systematic and structural optimization. During the same year, policies were introduced to promote the rapid construction and approval of advanced coal production capacity.

In 2021, despite high domestic supply, the robust demand and increased uncertainties in imports continuously pulled up coal prices. Policies promoting supply security, production growth, and capacity expansion were unveiled to stabilize the coal market.

Although the newly-added capacity presented a downtrend in the past three years, 2023 is still expected to see the total increment to exceed 234 Mtpa, including 108 Mtpa from capacity expansion and 126 Mtpa from newly-commissioned capacity.

The mines with capacity expansion last year were concentrated in coal-producing bases of Shaanxi, Xinjiang, Inner Mongolia, Shanxi, Yunnan, Gansu, Guizhou, Ningxia, Liaoning, and Sichuan.

The newly-commissioned capacity mainly includes capacity that is converted from newly built, renovated, expanded, or canceled announcement status to production status or trial operation status and primarily concentrated in main producing areas such as Shanxi, Shaanxi, Mongolia, and Xinjiang.

While capacity increment in Inner Mongolia, Shaanxi, and Xinjiang was mainly contributed by new coal mines due to their favorable mining conditions, renovation and expansion of existing coal mines was the major driver in Shanxi.

In addition, Guizhou, Yunnan, Heilongjiang, and Henan have accelerated the merger and reorganization of small coal mines with capacity below 300,000 tonnes per annum, contributing more than 20% of newly commissioned production capacity.

Capacity overview

China’s total coal production capacity is forecast to reach 6,208.07 Mtpa by the end of 2023, up 2.8% year on year. This includes 5,117 Mtpa in operation and trial run, accounting for 81.4%, and 765 Mtpa under construction, 12.32%.

Besides, the capacity of coal mines with suspended or delayed construction is 284 Mtpa or 4.57% of the total. Such capacity is mainly in a long-term suspension status due to various reasons including resource conditions, construction conditions, funds and policies. Part of them may be revitalized in the future, some may be replaced by new projects while some may be closed.

In addition, about 42 Mtpa or 0.68% of capacity belongs to coal mines that were excluded in the government’s official capacity announcement. These mines are mostly characterized by poor resource conditions, imminent resource depletion, outdated mining methods, cross-seam production, numerous safety hazards, and expiration of production permit. Some of these mines will gradually close to start new projects with lower capacity, some will resume production after obtaining permits, and others will be retained through rectification, mergers, or capacity expansion.

China is expected to set up a coal mine capacity reserve system and orderly approve the construct of a batch of capacity reserve coal mine projects to form a certain scale of dispatchable coal capacity reserve by 2027, according to the “Implementation Opinions on Establishing a Coal Mine Capacity Reserve System (Draft for Comment)” issued by the National Development and Reform Commission on December 6, 2023.

By 2030, the capacity reserve system is expected to be more sound and the capacity management system more perfect. Efforts will be made to achieve a dispatchable capacity reserve of 300 Mtpa. Based on the planning data collected from various provinces and major mining areas, it is estimated that there is still 860 Mtpa of basic capacity that meets the reserve conditions before 2030.

It can be seen that the reserve capacity is relatively sufficient, but due to the long construction period of coal mines, the capacity that can be put into operation in the short term is limited.

Capacity projections

Looking ahead to 2024-2028, China’s coal industry will continue to focus on building high-quality capacity and phasing out outdated capacity. By implementing strategies like capacity reduction and layout optimization, the industry aims to achieve an intensive and efficient coal development pattern, continually releasing high-quality capacity. In terms of phasing out outdated capacity, the focus is on accelerating the elimination of capacity associated with resource depletion, high safety risks, high production costs, significant mining difficulties, and financial distress.

Looking at the current existing capacity, the potential for capacity expansion is decreasing. In 2021, tight coal supply prompted the government to implement policies to accelerate the release of coal mine capacity. The potential for capacity expansion and new production capacity has been vigorously explored in the following three years.

However, after supply from these capacity stabilized, the potential for future capacity expansion may require a longer preparation and construction period to be released. The incremental release of existing capacity in the future is expected to be relatively limited.

It is anticipated that the new production capacity will gradually decrease over 2024-28 and a similar trend is also expected in the phased-out capacity during this period, according to the Fenwei Coal Mine Database analysis, with the consideration of the current construction progress of mines, the development plans of coal enterprises for their mines, and relevant national policies and regulations.