Amid inflation and a global economic slowdown, BHP’s outlook for the steel industry in China, the world’s largest steel producer, has become less optimistic.

This comes after a lackluster performance in fiscal year 2023, which saw a combination of pronounced weakness in housing starts, strength in infrastructure and mixed outcomes for the machinery sector, among others.

Global steel production reportedly edged up by 0.1% to 1.89 billion tonnes in fiscal year 2023, which BHP calls a “weak follow up” to the 4% decline in the 2022 fiscal year, the mining giant said on Tuesday February 20.

In its latest economic and commodity outlook released on Tuesday, BHP said that the global production rate in the 2023 fiscal year, which ended in June 2023, suits the performance of the steel industry in developed regions, but not the populous emerging markets, led by China and India.

“[Mainland China and India] were a collective ‘source of stability’ for global commodity demand in calendar year 2023, as anticipated, with the steelmaking value chain at the center of that. The disconnect for the developing world comes from the different conclusions that might be drawn from official and alternative measures of production,” BHP said.

The company added that an alternative measure of Chinese production, derived from physical indicators of feedstock consumption and survey data on capacity utilization, would add around 30 million tonnes to the official figures, raising the world steel growth rate to around 1.5%.

Here are some key points of BHP’s report:

1. China hits 1 billion tonnes in crude steel production

China recorded its fifth consecutive year of crude steel production above 1 billion tonnes on the back of solid demand from non-housing sectors.

The country’s steel sector also saw a significant jump in net exports, with the sum reaching a seven-year high in the 2023 fiscal year. Exports rose to 87 million tonnes, with multiple months above 90 million tonnes and hit a peak of 98 million tonnes in 2023.

India also had a strong year in 2023, with crude steel production of 140 million tonnes, up 12% year on year and up by 40% since 2020.

India’s market had been the lone bright star in Asia in terms of steel market strength amid persistently weak demand and oversupply in the region over 2023; with demand in the country remaining robust despite strong global headwinds and rising interest rates.

Market participants attributed the resilience of the Indian market to steady investments into the country amid its government’s focus on building infrastructure ahead of the general election in 2024, coupled with rapid population growth and the growing trend of urbanization in the country.

2. China’s robust BF utilization rate

China’s blast furnace (BF) utilization rate averaged a robust 88% in the first half of 2023, and 90% in the second half, hitting 89.1% for the full year. This is compared with 84% in the 2022 fiscal year.

BHP said BFs have been able to run at elevated rates for three reasons. Firstly, production at electric arc furnaces (EAF) was constrained by a lack of competitiveness, weak demand for construction steels, diminished availability of scrap and a loss of profitability.

Apparent demand for long steel declined by an overall 9% year on year in the 2023 fiscal year, dropping by 14% year on year in the second half of the year alone, reflecting, for the most part, a decrease in housing starts, BHP said.

Secondly, the availability of global export markets also increased BF utilization rates, despite an oversupply of steel. The rate of exports in China rose by around 30 million tonnes per year in the first half of the 2023 fiscal year compared with the whole of 2022.

Thirdly, the performance of flat steel in 2023 was relatively resilient, with apparent demand increasing by 2% year on year and 3.2% year on year in the second half of the year, due to growth in manufacturing sectors.

3. Realized margins for Chinese steelmakers poor

Realized margins for Chinese steelmakers were poor throughout the 2023 fiscal year. In the first three quarters of the year, mills operating EAFs continued to endure consistent losses, while those operating BFs were just above net zero on average. Steelmakers with higher exposure to less-commoditized products or manufacturing end-use did “a little better”, though BFs producing construction steel joined EAFs in making losses.

BHP estimated that BF-BOF (basic oxygen furnace) spot margins averaged around $7 per tonne in the 2022 calendar year, but they fell to negative $6 per tonne in the 2023 fiscal year. During the Covid-19 pandemic, BF-BOF steelmakers were forced to consume working capital by building stocks through lockdown periods, on the hope that demand would still be robust post-pandemic.

“That produced abnormally large stock builds, sometimes out of the regular seasonal pattern. It does feel odd that a successful return to a leaner finished inventory strategy has occurred without an improvement in profit,” BHP said.

4. China to increase accumulated stock of steel by mid-century

In the long term, BHP believes that China will increase its accumulated inventories of steel in use, which is around 9 tonnes per capita, by between 1.5 and 1.75 times to an urbanization rate of around 80%. The country is also expected to improve its living standards similar to those of nations currently on the fringe of the high-income bracket by the middle of this century.

“China’s current stock is still well below the current United States level of around 12 tonnes per capita. Germany, South Korea, and Japan, which all share important points of commonality with China in terms of development strategy, industry structure, economic geography, and demography, have even higher stocks than the US,” BHP said.

The company added, “The exact trajectory of annual production run-rates that will achieve this near doubling of the stock is uncertain. Our base case remains that Chinese steel production is in a plateau phase, with the literal peak likely to be the cyclical high achieved in this period.”

5. China’s end-user demand to remain mixed in 2024

BHP’s outlook for China’s 2024 economy remains conditional, and it expects an increase of 4.5% to 5% in real GDP, after a 5.2% growth in 2023 which saw a combination of pronounced weakness in housing starts, strength in infrastructure, mixed outcomes for machinery, solid outcomes for autos and shipbuilding, consumer goods, and weaker sales of metal goods.

The company pointed out key considerations when assessing the end-user demand for Chinese steel for 2024, which includes the pace, scale and composition of the housing construction recovery, and the steel intensity of the same unit of gross domestic product.

Steel intensity refers to the amount of steel used per unit of gross domestic product.

For example, a housing start is more crucial gauge for steel intensity than a project completion due to its higher demand for rebar, while a commercial dwelling has more floor space than standard public housing and contains more steel than a rural dwelling.

BHP said that the infrastructure upswing is expected to continue and underpin steel demand after China’s fixed investment in infrastructure recorded an 8.2% year-over-year growth in 2023.

6. China’s steel exports to dip to between the 2022 and 2023 outcomes in 2024

China’s net steel exports in 2024 is expected to shrink from that of 2023 by up to over 87 million tonnes given Beijing’s attempts to rein in steel production, but the decline is set to be limited and unlikely to fall below 2022’s level of 54 million tonnes, because the incentive to export from a price perspective has substantially increased with rallies in other major regions, BHP said.

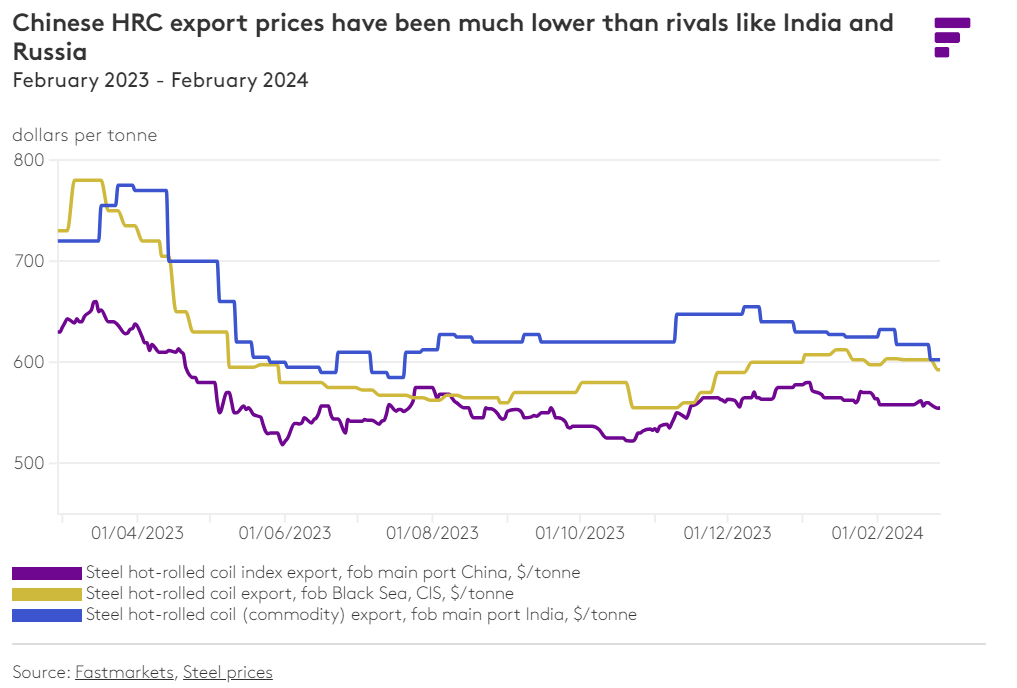

Chinese HRC export prices, for example, were much lower than rivals like India and Russia.

Fastmarkets’ calculation of its daily index for steel HRC index export, fob main port China averaged $574.51 per tonne in 2023.

Fastmarkets’ assessment of steel hot-rolled coil export, fob Black Sea, CIS, averaged $613.94 per tonne last year, while the assessment of steel hot-rolled coil (commodity) export, fob main port India, averaged $651.35 per tonne.

7. China’s steel output to plateau in 2024

BHP’s preliminary estimate for China’s crude steel production in 2024 is in the range of 1 to 1.1 billion tonnes – a plateau range which will extend to a six-year streak from a five-year streak between 2019-2023.

Official statistics may even indicate a broadly flat outcome from the 1.019 billion tonnes reported for the year of 2023, BHP said.

BHP noted that production may be affected by possible mandated production cuts in China, though the company pointed out that “each and every year, the breadth, timing and severity of any prospective cuts are uncertain”.

Dubbing the 2023 fiscal year the “Godot never came” year because there was no real decrease in BF utilization, among others reasons, BHP said the outlook on crude steel production for the 2024 fiscal year remains uncertain.

By the Fastmarkets team, Jessica Zong, Zihuan Pan, and Nabilah Awang